Darren Krett

Monday, 22 January 2024

Netflix Earnings Trades

0

Comments (0)

Darren Krett

Tuesday, 23 January 2024

Share on:

Post views: 3513

Categories

Blog

So here we are again….everyone’s favorite trading stock Tesla has its quarterly earnings. Now while our system does not give you a direction, it will tell you the best option trade based on your view. Up/down, vol up or vol down..I can show you what to do.

Looking at the chart, while I could easily see a push-up to the trendline at around $222, but it still looks like the overall trend is bearish.

chart doesn't look that great![]

So to represent this (a short term move up followed by a rejection and move lower) I am running a very short-term upside play, with a more medium-term downside one.

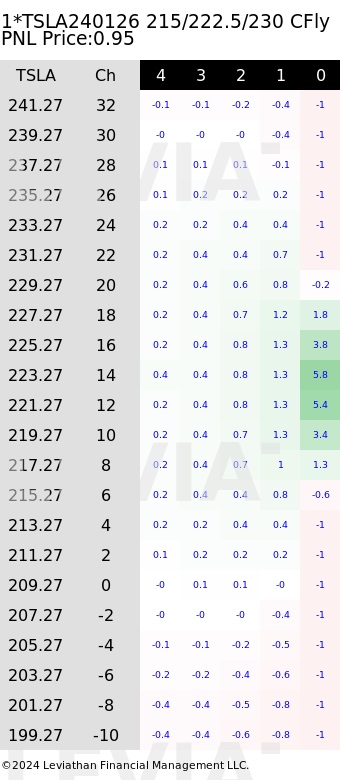

My upside trade is targeting the following;

$222 target with a bit of wiggle room

$222 target with a bit of wiggle room

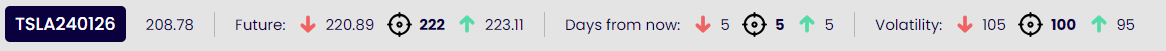

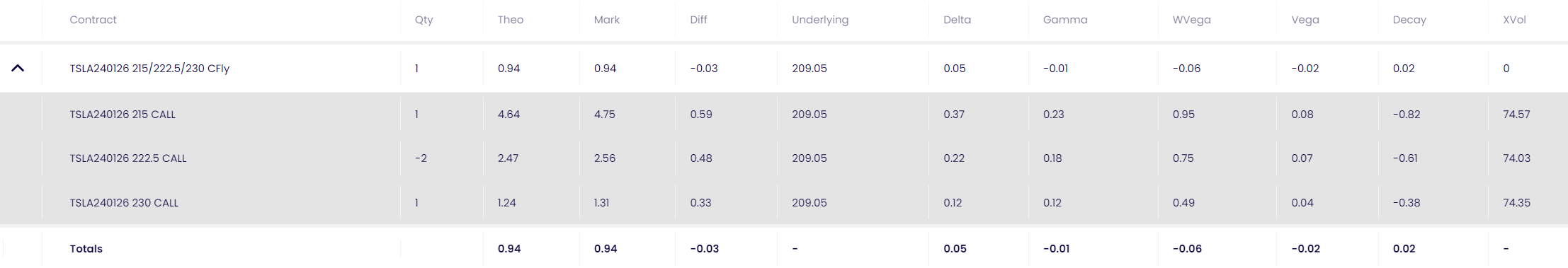

So BB1 came up with the following list based off my $222 target with a 221/224 range to make money

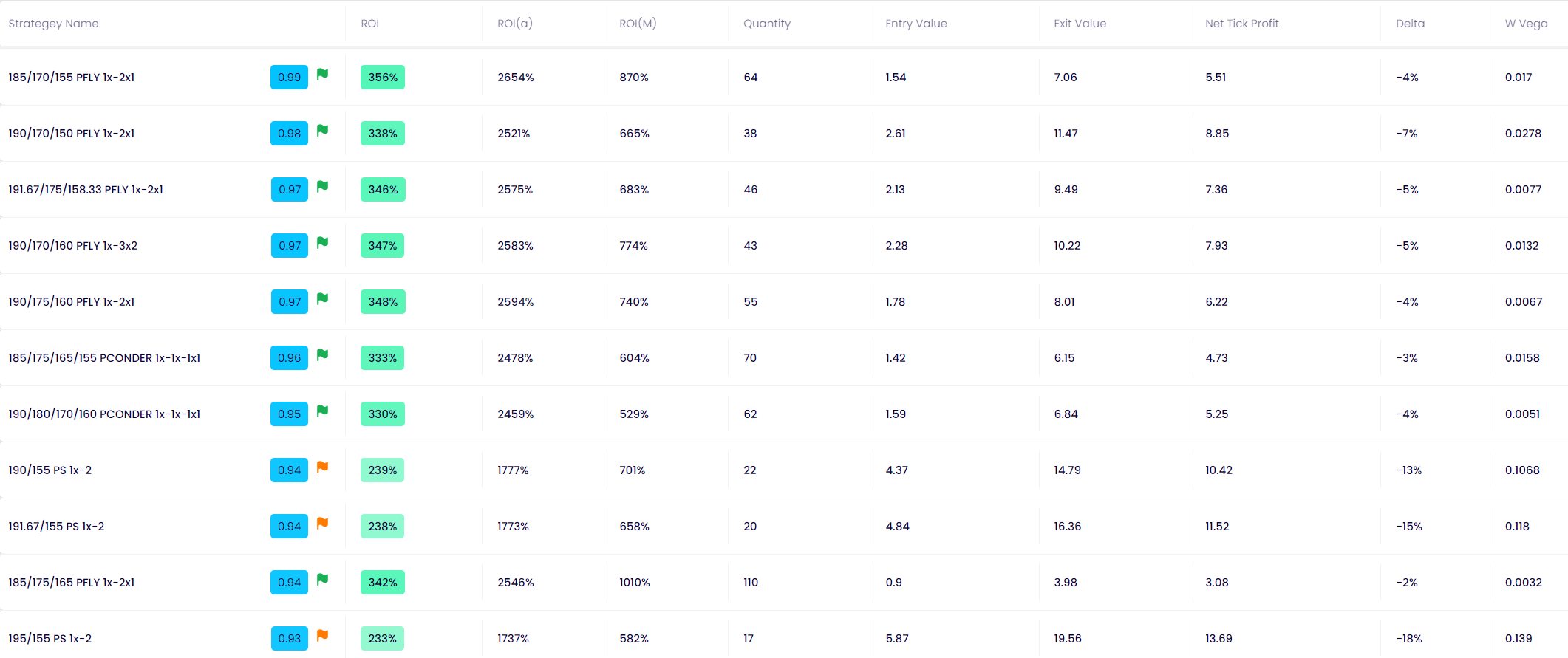

Out of the list I chose the 215/222.5/230 call fly 90 times(contracts)... at around 94 cents its not a bad upside punt, just bear in mind that this is a 3 day option...either you'll be laughing or it will be a total loss..this would be the P&L of that trade...

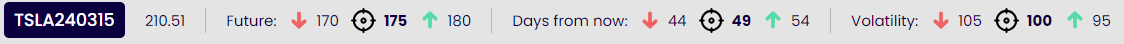

The downside trade is looking our days from now, give or take ( our system will not specify an exact point unless you ask it to, because in the real world that rarely happens) with a target RANGE of $170 to $180

here's my target price range, date range and volatility range

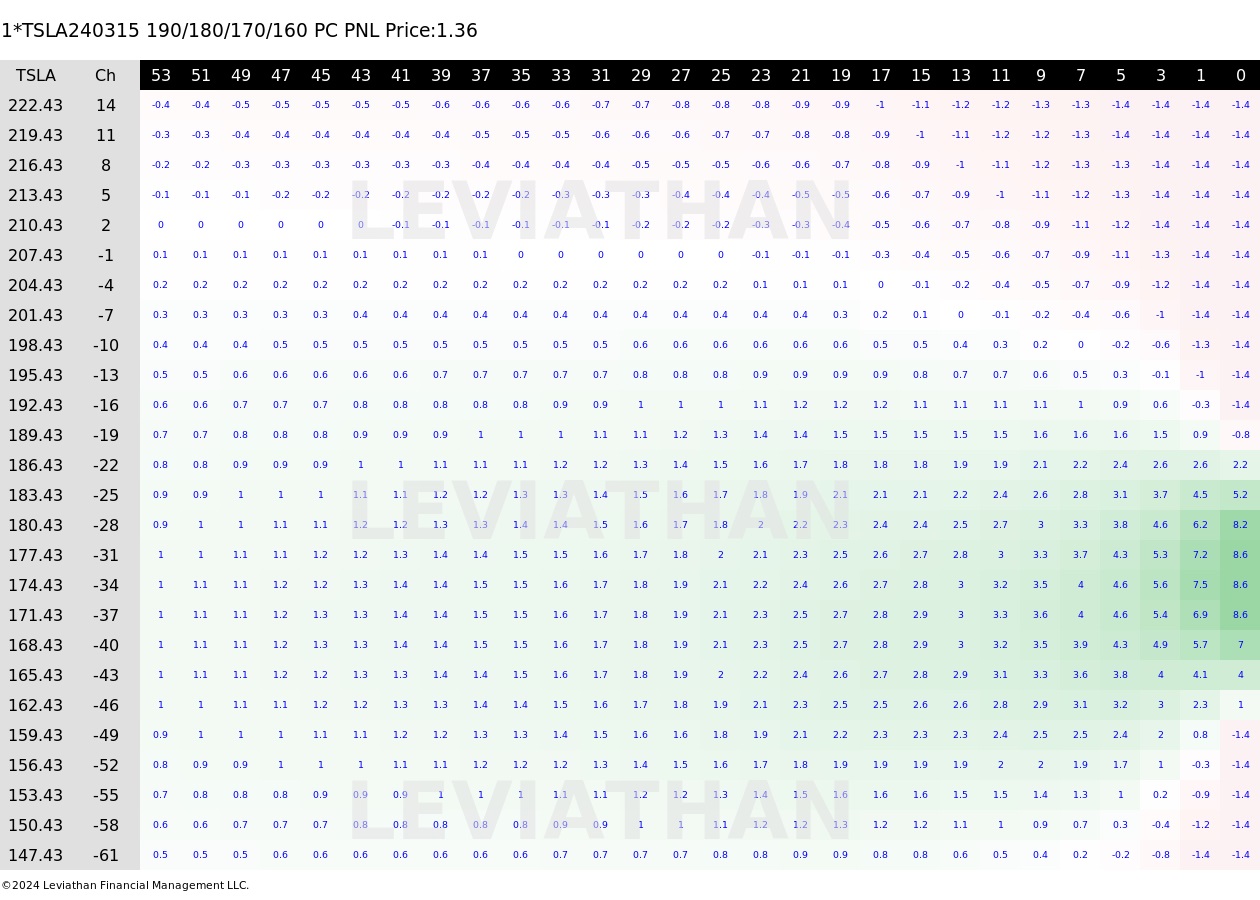

and out of this,I went for...... the 160/170/180/190 put condor

the 160/170/180/190 put condor and its component parts

the 160/170/180/190 put condor and its component parts

Just check out the heat map...a lot of green...

your downside play heat map

your downside play heat map

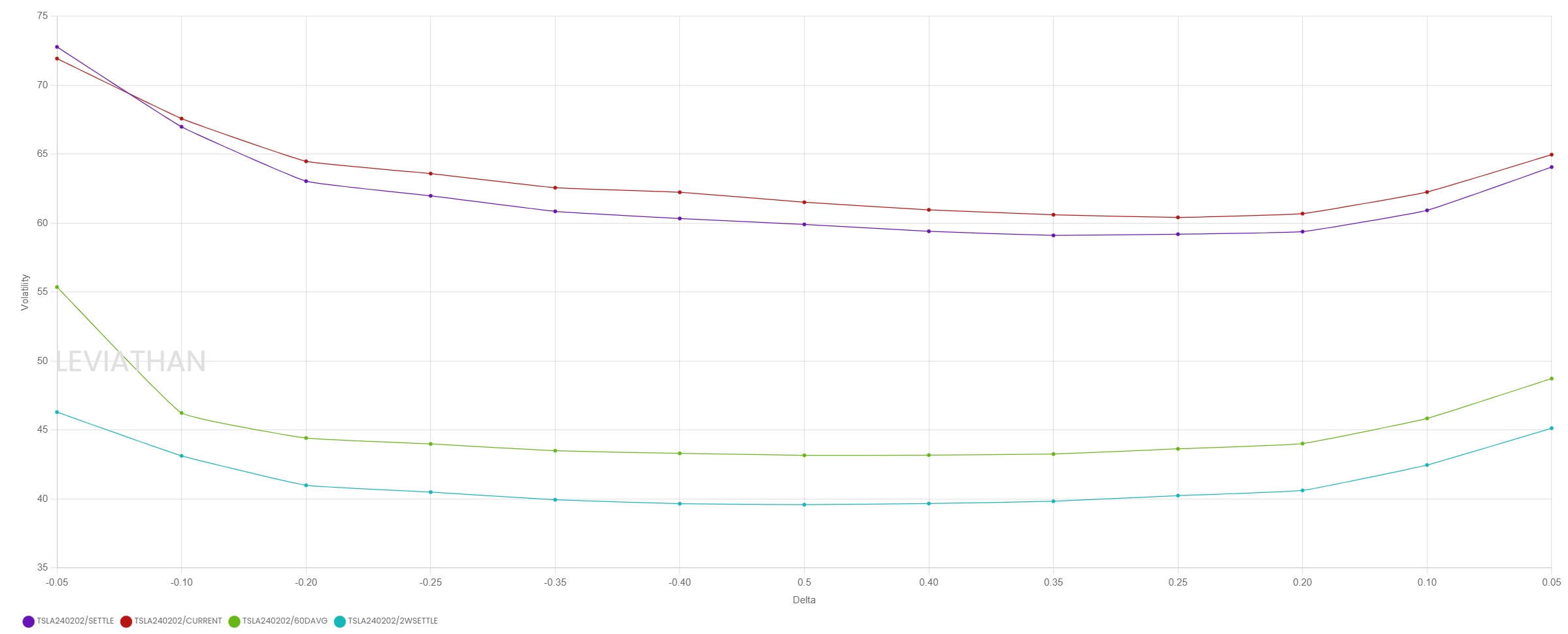

the system is taking advantage of the increased put skew to show that this is relatively cheap and on a risk/reward basis is probably the best trade to do

the 5 & 10 delta puts are a little rich

the 5 & 10 delta puts are a little rich

Darren Krett

Monday, 22 January 2024

0

Comments (0)

Darren Krett

Monday, 31 October 2022

0

Comments (0)