Darren Krett

Wednesday 31 January 2024

Apple earnings option plays

0

Comments (0)

Darren Krett

Sunday 4 February 2024

Share on:

Post views: 2208

Categories

Blog

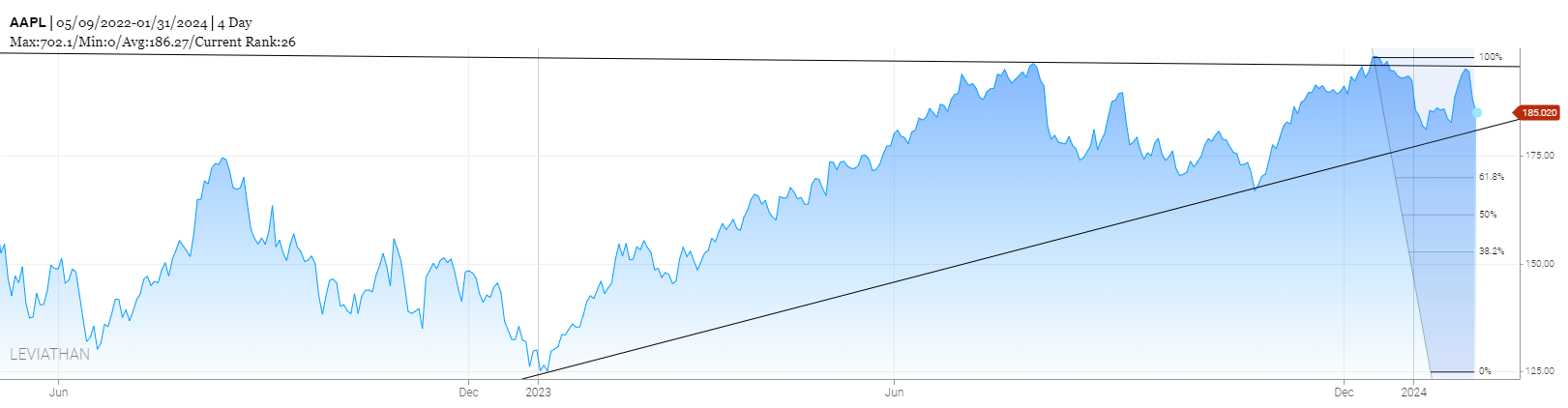

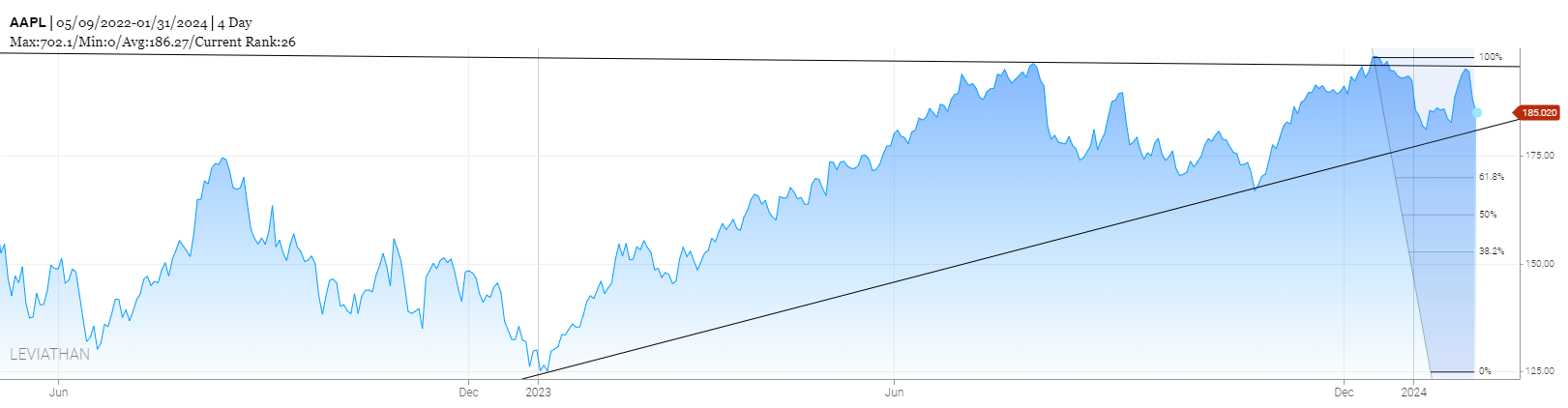

Looking at the chart, this could be about to have the breakout you've all been looking for....

another run to the upside?

another run to the upside?

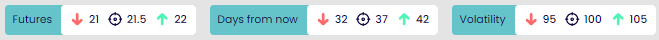

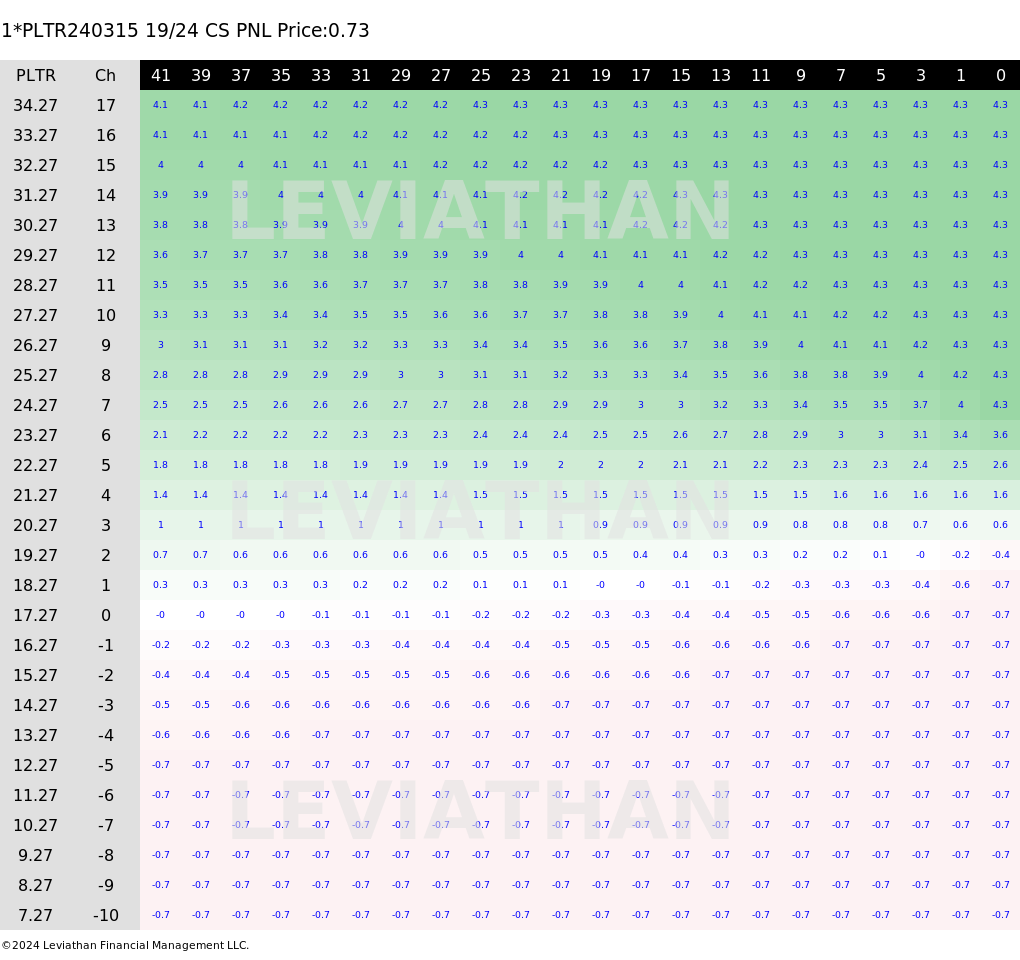

Im going to run 2 scenarios through BB1, the first is a more realistic charge to retest the $21.50 area

So, making money between 21 & 22, 37 days from now....I did a run for a shorter timeframe too, but based on the ROI you may as well give it a bit more time, so Im using the March expiration to work with, knowing I will be out beforehand...

So, making money between 21 & 22, 37 days from now....I did a run for a shorter timeframe too, but based on the ROI you may as well give it a bit more time, so Im using the March expiration to work with, knowing I will be out beforehand...

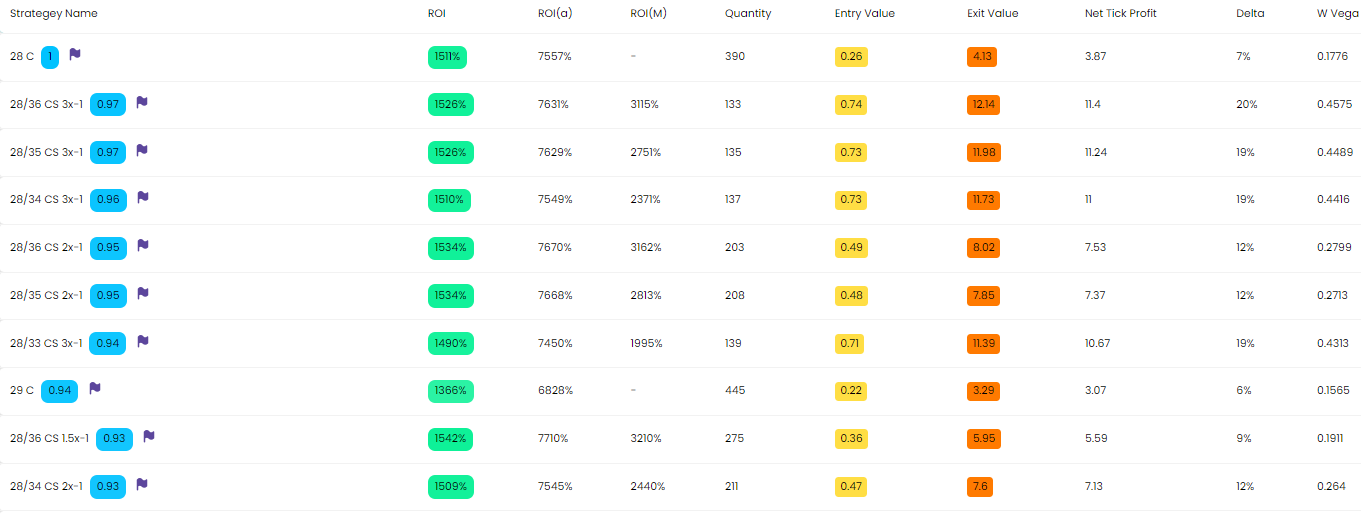

here's the list

here's the list

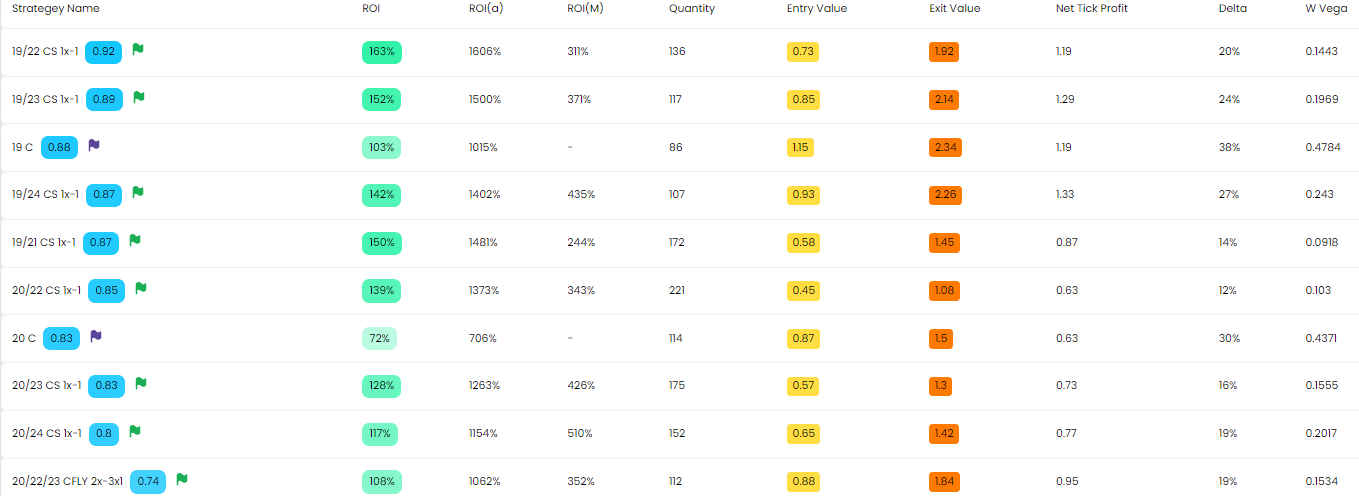

On a risk/reward and relative value basis, these were BB's best picks. Out of the top 10, I have decided to go with the 19/24 call spread or bull spread (whatever terminology you prefer)..

I like how it works on the way up and you can double your money pretty quickly too

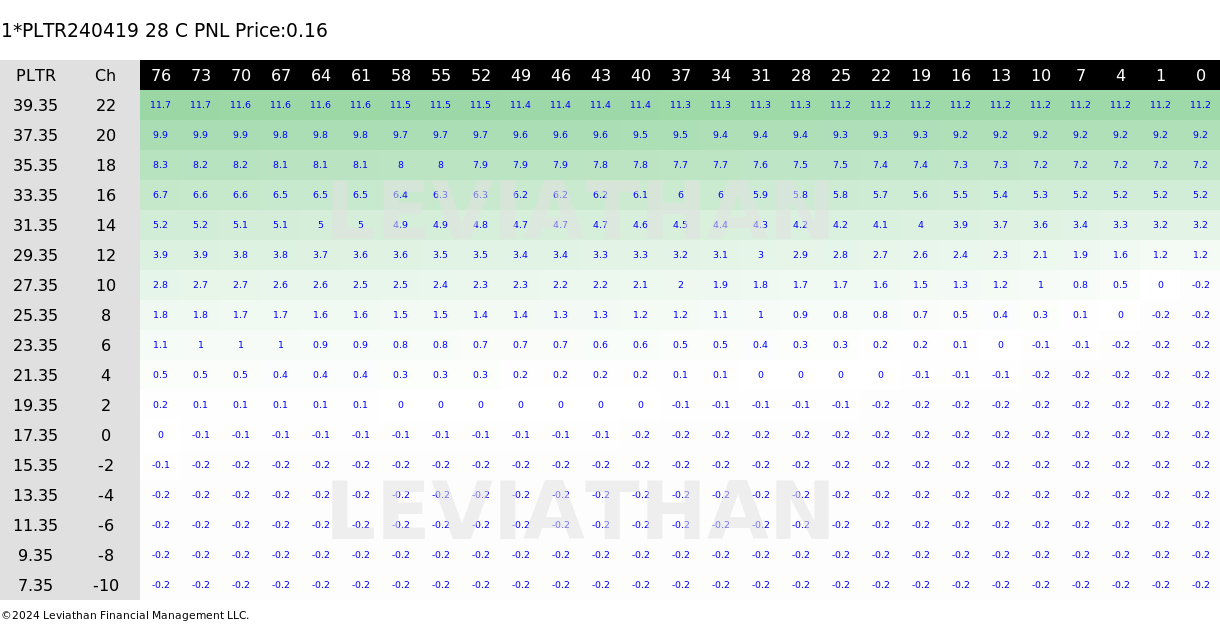

19/24 heat map

19/24 heat map

For the 2nd scenario, I went a little further out (April) and targetted the $32 area. As its a little less likey I also want a larger landing pad...

anywhere between $27 TO $37

anywhere between $27 TO $37

For the best Risk/reward and RV on this one, I am going to go with BB's advice and just buy the $28 calls

THe top 10 were pretty vanilla

THe top 10 were pretty vanilla

and for those of you that want a heat map for this

The layout for these is very little for an option that has nearly 80 days of play left. One of the reasons I do go out a little further is because and a couple of people have mentioned previously about their fear of "IV crush" There is less exposure to that for the dates I have chosen. Just think of it down to "chances of happening". For short-term 1 day or next-week expirations, even if you get the direction right you can still lose by owning calls...these trades will alleviate some of that risk so, if you like the upside, its either the MArch $19/$24 call spread or for a little longer the $28calls in April.

The layout for these is very little for an option that has nearly 80 days of play left. One of the reasons I do go out a little further is because and a couple of people have mentioned previously about their fear of "IV crush" There is less exposure to that for the dates I have chosen. Just think of it down to "chances of happening". For short-term 1 day or next-week expirations, even if you get the direction right you can still lose by owning calls...these trades will alleviate some of that risk so, if you like the upside, its either the MArch $19/$24 call spread or for a little longer the $28calls in April.

AND REMEMBER...ALWAYS RATHER BE LUCKY THAN GOOD :)

Darren Krett

Wednesday 31 January 2024

0

Comments (0)

Darren Krett

Tuesday 23 January 2024

0

Comments (0)