Darren Krett

Wednesday, 31 January 2024

Apple earnings option plays

0

Comments (0)

Darren Krett

Monday, 19 February 2024

Share on:

Post views: 2271

Categories

Blog

As Nvidia prepares to publish its much-anticipated full-year results this Wednesday you're all probably wondering what can I do to take advantage. For those of you who have read my posts in the past, I am NOT going to be recommending swing for the fences OTM options punts. My purpose here is to try to give you all the best chance of MAKING MONEY, so without further ado...

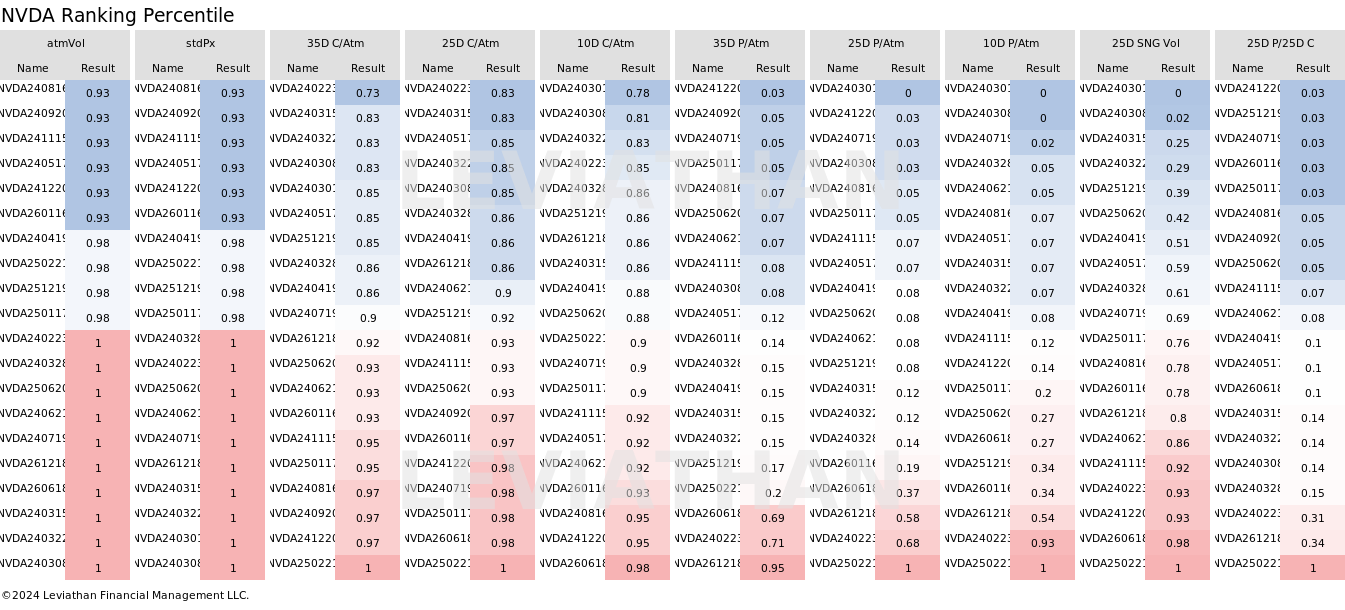

The calls are all expensive relative to ATM volatility, while the puts are all cheap. This should give you an idea of sentiment in this stock and given that the front months IV is always going to be a bit pumped going into earnings, I would avoid buying outright calls, you would need to be very right to avoid getting killed by the IV crush that will inevitably follow.

RV ranking of all delta options

RV ranking of all delta options

As you can see from our ranking tool, that all the calls are still expensive relative to the ATM volatility, while the puts are all cheap. THis should give you an idea of sentiment in this stock and given that the front months IV is always going to be a bit pumped going in to earnings,I would avoid buying outright calls, you would need to be very right to avoid getting killed by the IV crush that will inevitably follow.

So I have chosen 2 upside scenarios to look at and one downside, because you never know.

I like to allow my view to have a chance at working and hope that a good report will set the trend for the next 3 months. So my first scenario I am looking to see what can I get if we have a run towards the $1000 area, but I want to be able to make money well before we get there..

targetting $950 but want to make money above $912 and im giving myself 90 days to do it

targetting $950 but want to make money above $912 and im giving myself 90 days to do it

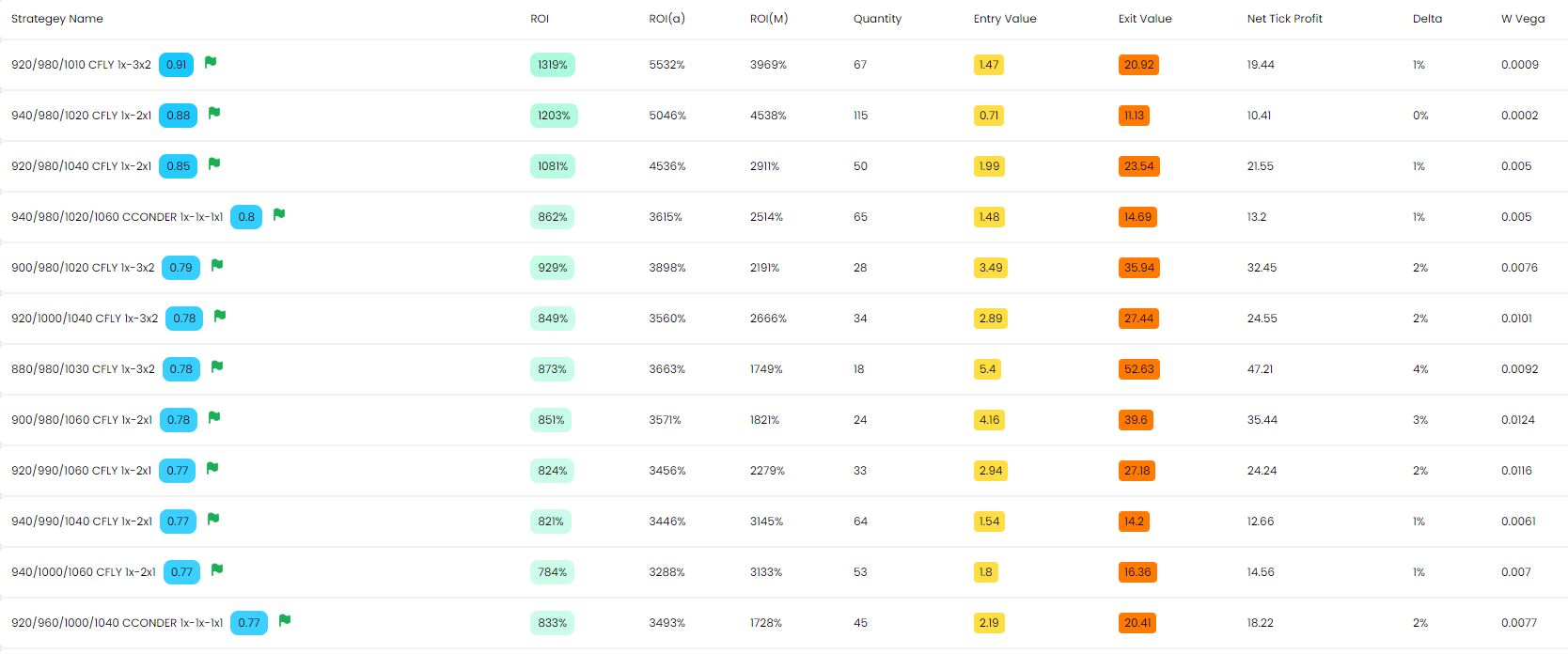

THis is the list that BB1 generated

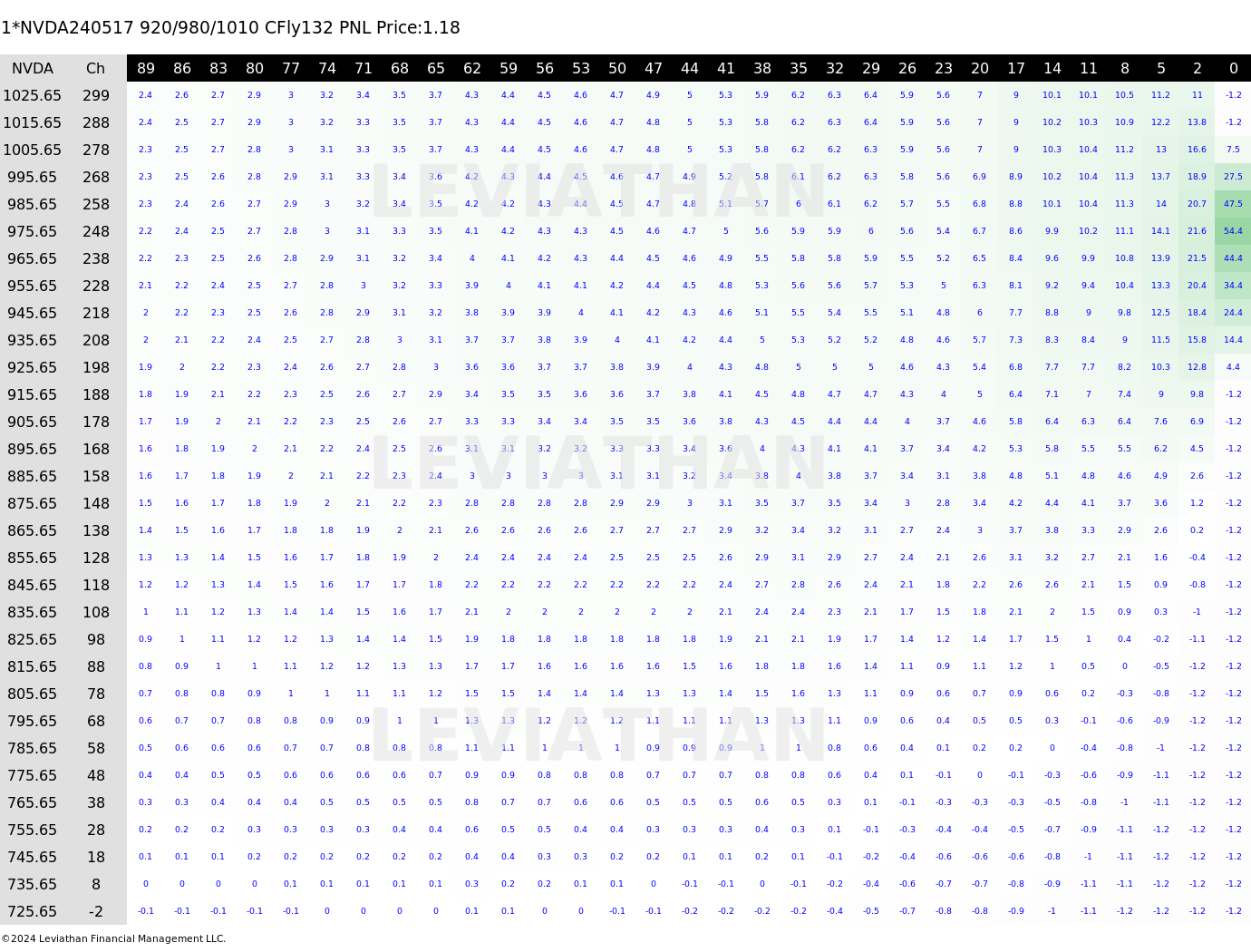

I am going to trust the system and choose the top pick which is the 930/980/1010 call fly 1x3x2. It is a ratio fly that has a great "trade score" (where the AI system assesses the risk/reward not just running monte carlo historical VAR simulations but also forward-looking too)

I am going to trust the system and choose the top pick which is the 930/980/1010 call fly 1x3x2. It is a ratio fly that has a great "trade score" (where the AI system assesses the risk/reward not just running monte carlo historical VAR simulations but also forward-looking too)

To see what my risk is, here is the HEAT MAP of that trade,

You will be making money straight away if the direction is correct but really kill it if we do grind higher over the next few weeks.

You will be making money straight away if the direction is correct but really kill it if we do grind higher over the next few weeks.

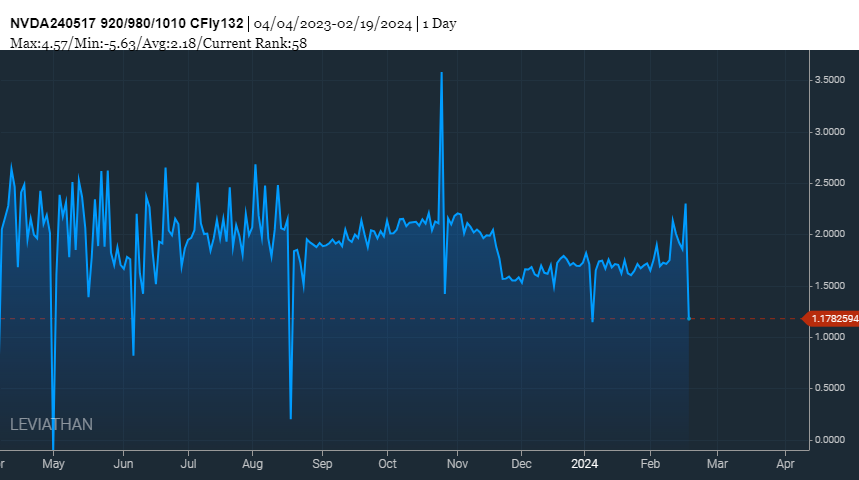

Historically this structure is fairly valued but still well below the average price of a similar OTM fly at this stage of the cycle.

Historically this structure is fairly valued but still well below the average price of a similar OTM fly at this stage of the cycle.

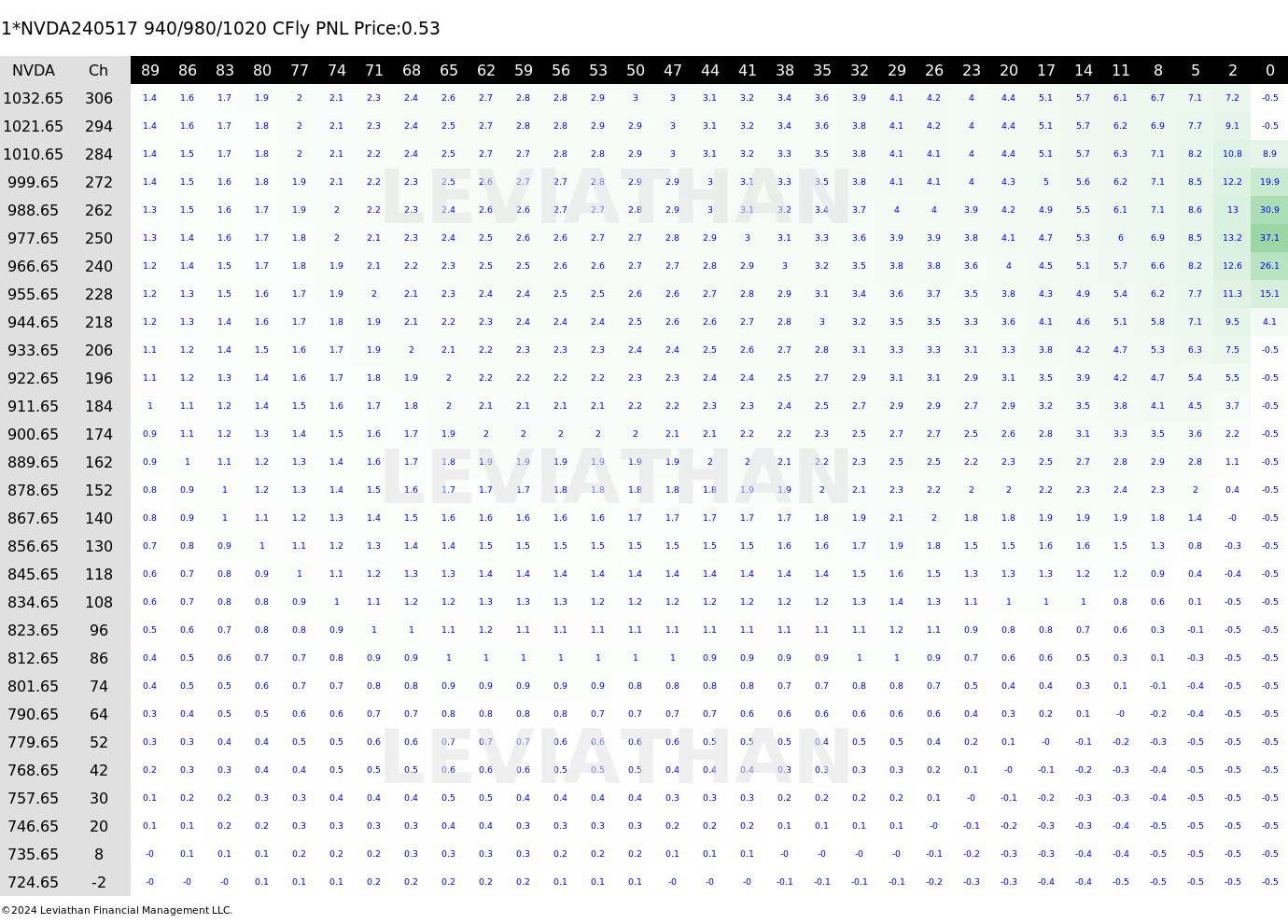

The other option would be the regular 940/980/1020 call fly, also expiring in May. I do like this one too as you know what your max downside is and it is pretty cheap at around 50 cents

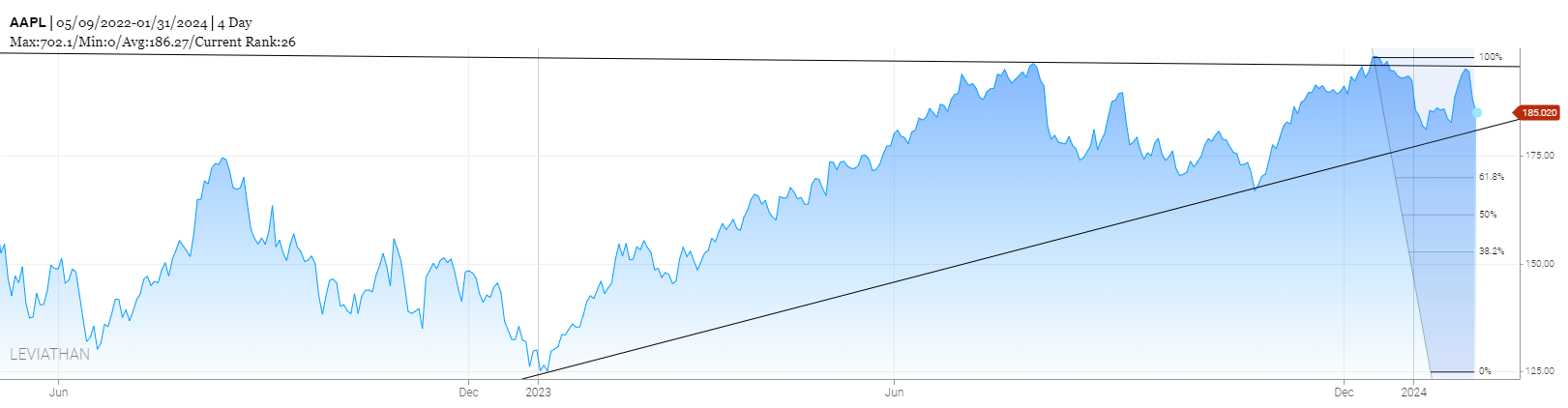

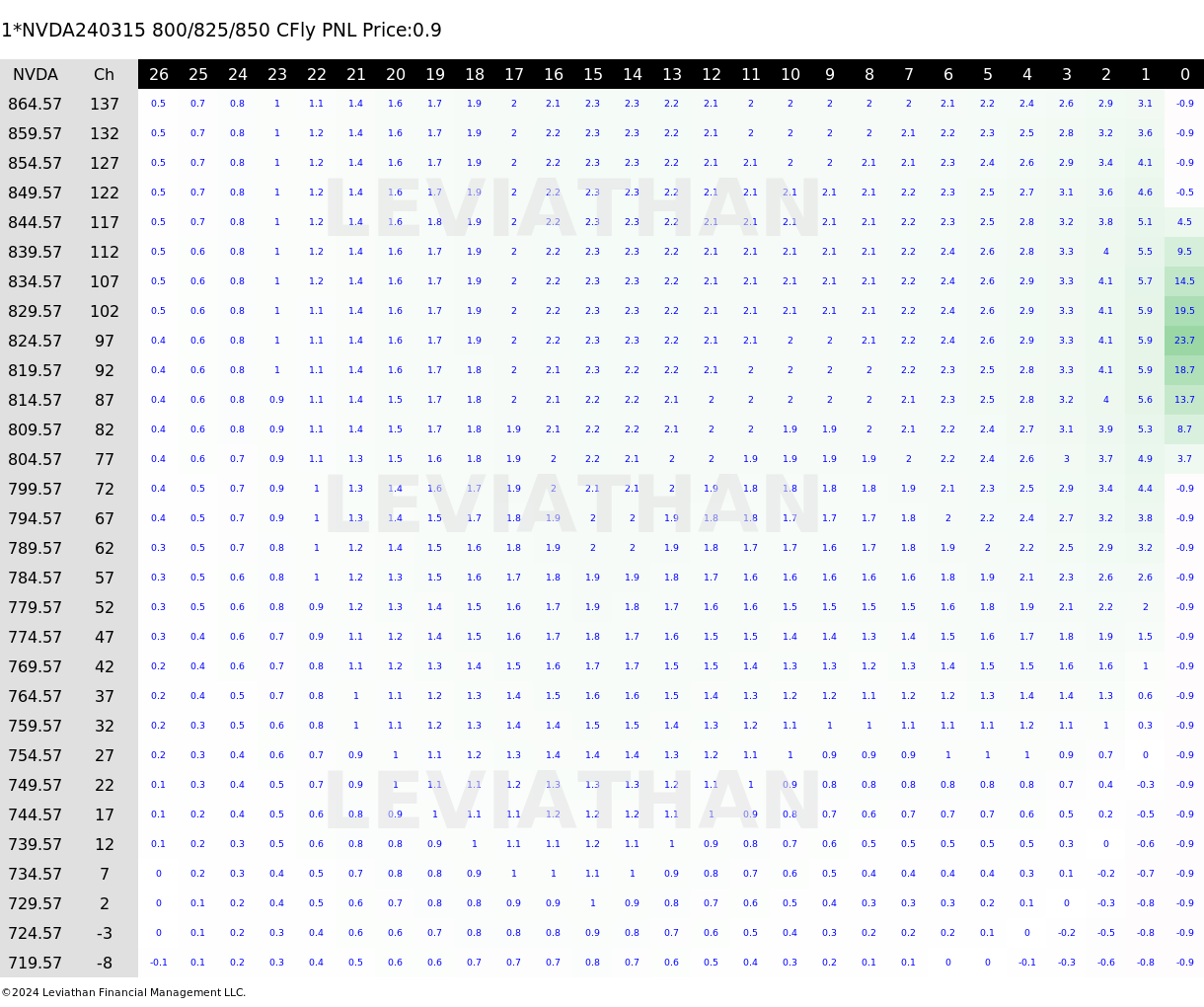

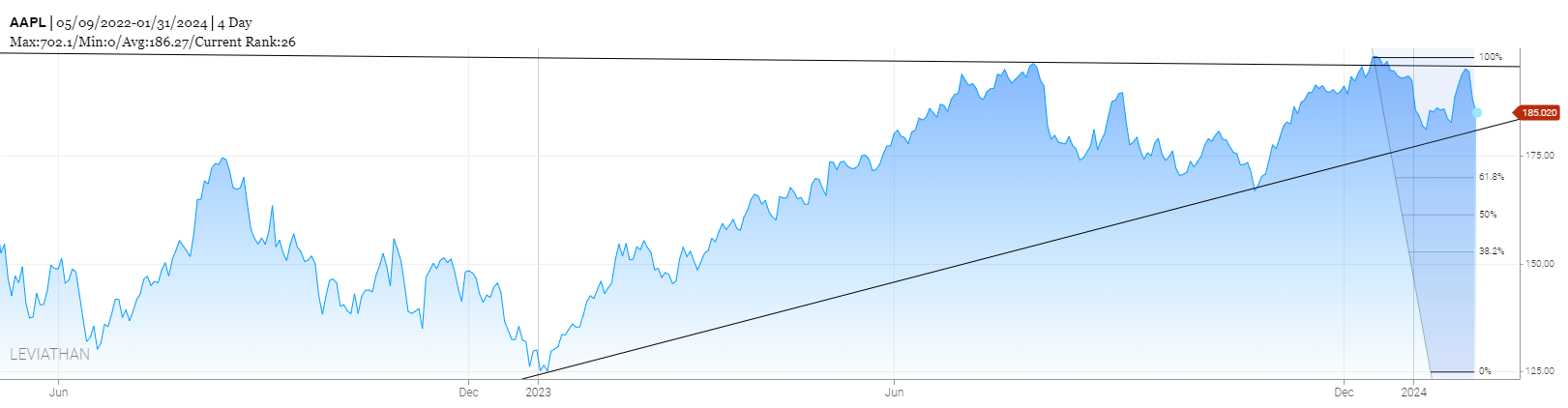

For those that would prefer a more shorter time frame I did take a look at a trade in the March expiration, so still giving you a little bit of time to work with. Looking at the chart it isn't difficult to see a potential quick run to the top of that channel which would come in at $822

So with that in mind,

you have 28 days to get above $800

you have 28 days to get above $800

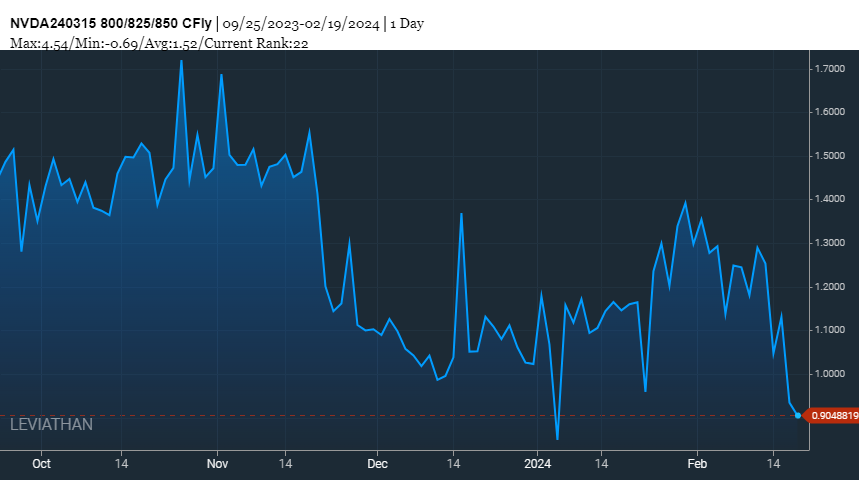

Its the $800/$825/$850 call fly at around $1 is a cheap punt and you know your downside.

- This call fly is relatively cheap too

- This call fly is relatively cheap too

As this fly is currently in its 22nd percentile it is relatively cheap and I think a worthy punt.

There are no guarantees that we go up so why not have a little look at the downside....

We could easily retrace back to the $625 area but I want a wide range and then give myself 2 months to get there.

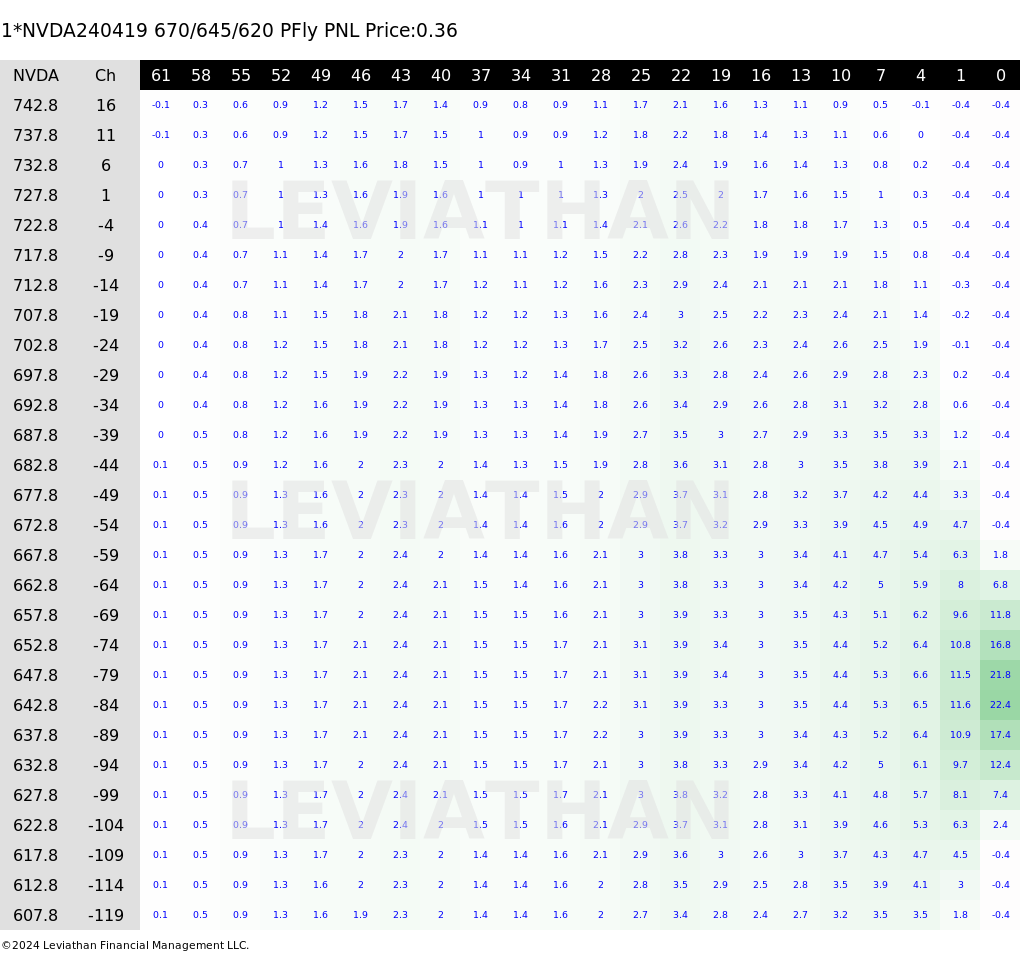

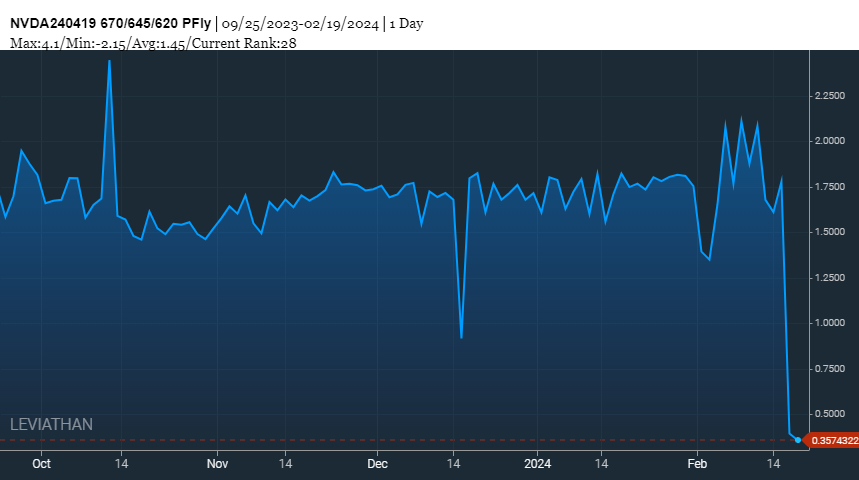

The $620/$645/$670 put fly, at a mere 36cents is a great little downside trade

This thing monetizes pretty quickly too

This thing monetizes pretty quickly too

This fly has is great value on an RV basis

This fly has is great value on an RV basis

While I still like the upside there are ways to protect yourself cheaply.

And as always, remember IT IS ALWAYS BETTER TO BE LUCKY THAN GOOD, so good luck girls and boys & happy hunting...

Darren Krett

Wednesday, 31 January 2024

0

Comments (0)

Darren Krett

Tuesday, 23 January 2024

0

Comments (0)