Darren Krett

Tuesday, 12 March 2024

Option Plays for Lennar (LEN) and beyond

0

Comments (0)

Darren Krett

Tuesday, 19 March 2024

Share on:

Post views: 1767

Categories

Blog

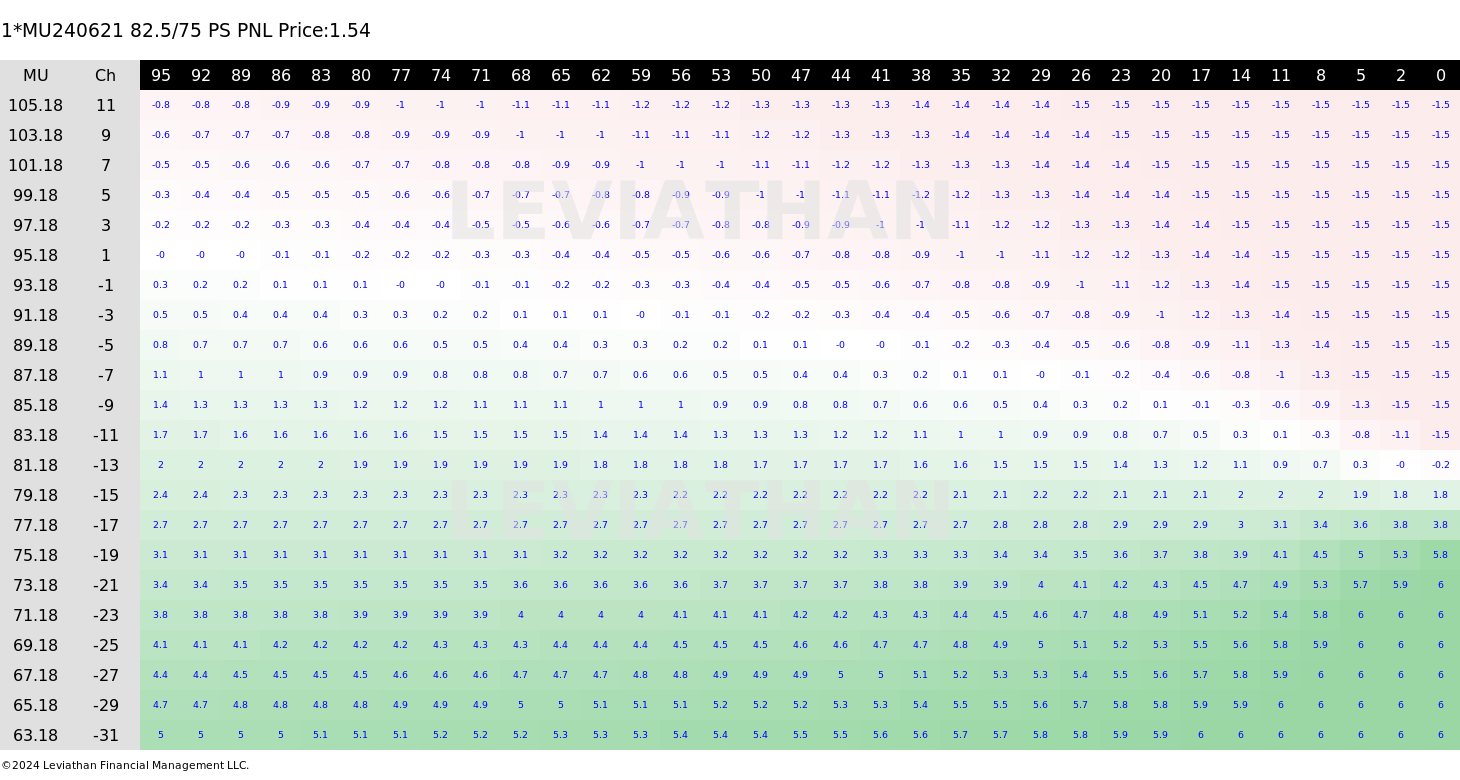

Micron Technology earnings out tomorrow so is there anything to do? There's always something to do in the wonderful world of options :)

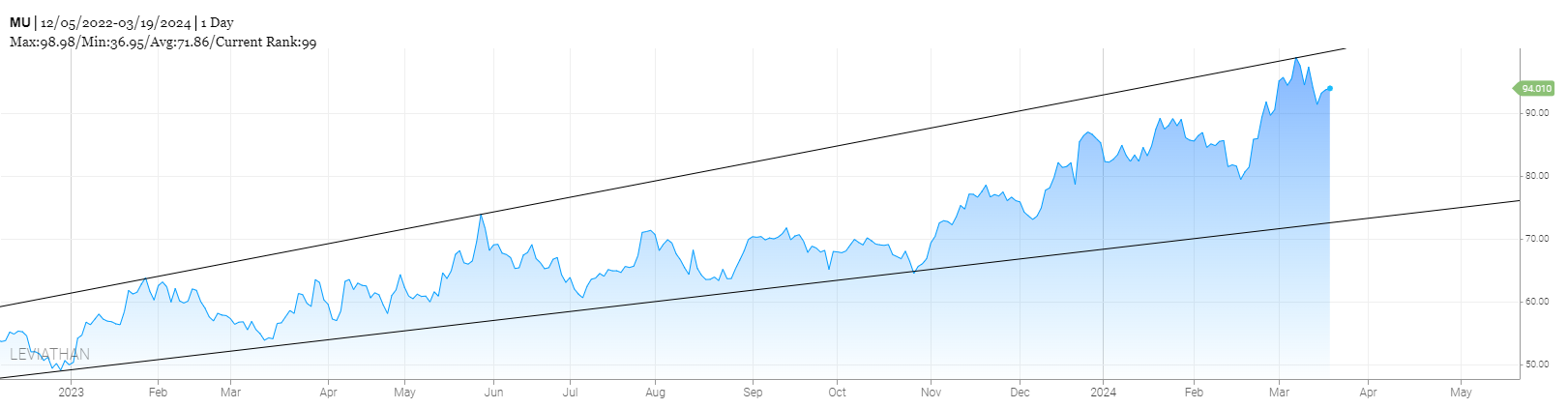

been on a nice rally since last year

been on a nice rally since last year

So looking at this channel It seems the upside could be capped and not too far from where we are now, with the top of the channel coming in around $100. I am going to go slightly shorter term than usual

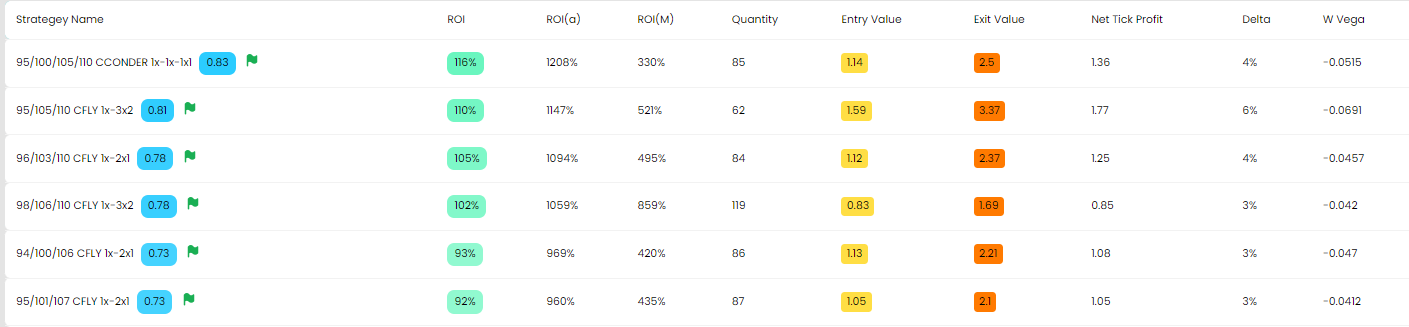

Just over a month from now and looking to make money between $96 to $104

Just over a month from now and looking to make money between $96 to $104

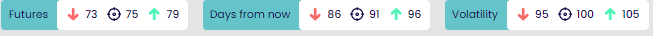

BB1 list

BB1 list

Just going for the top choice and picking the Call Condor...maybe not the most exciting play in the world but its a solid return on not an unreasonable scenario

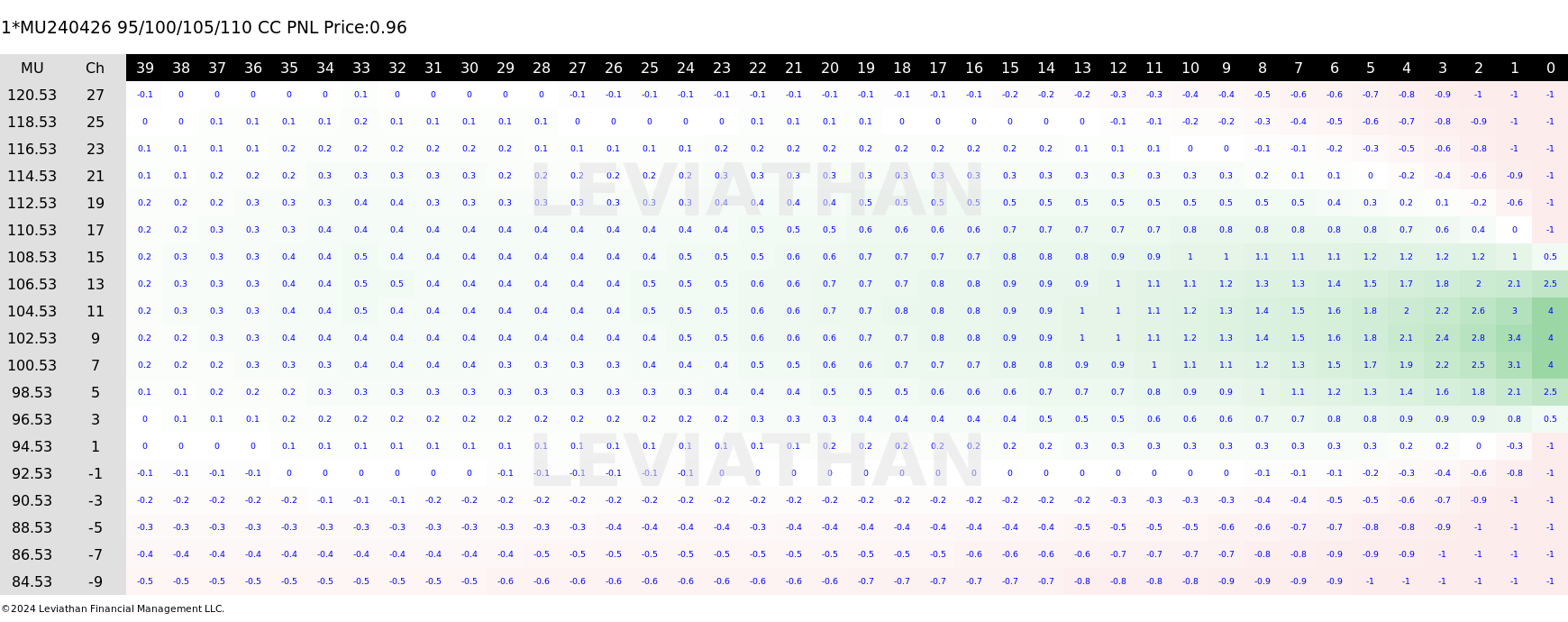

getting in for around $1 on the call condor that will monetize pretty quickly too.

For the downside I am looking for the bottom of the channel which comes in at $75 and I am giving this one a bit more time to realize.

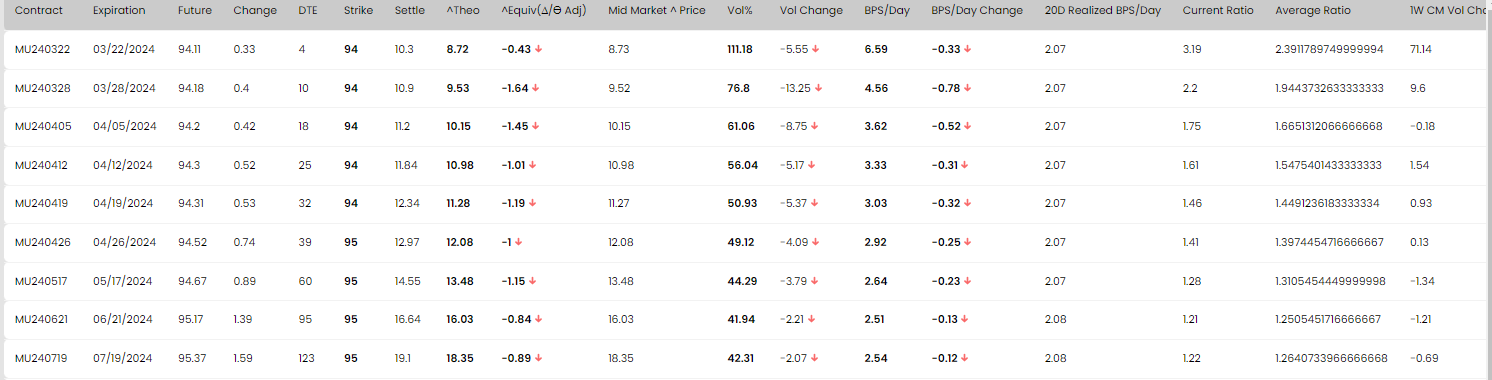

Implied volatility

Implied volatility

With a pumped up expected range of $6.50 tomorrow, double that of the further out months where the norm is around $3.00

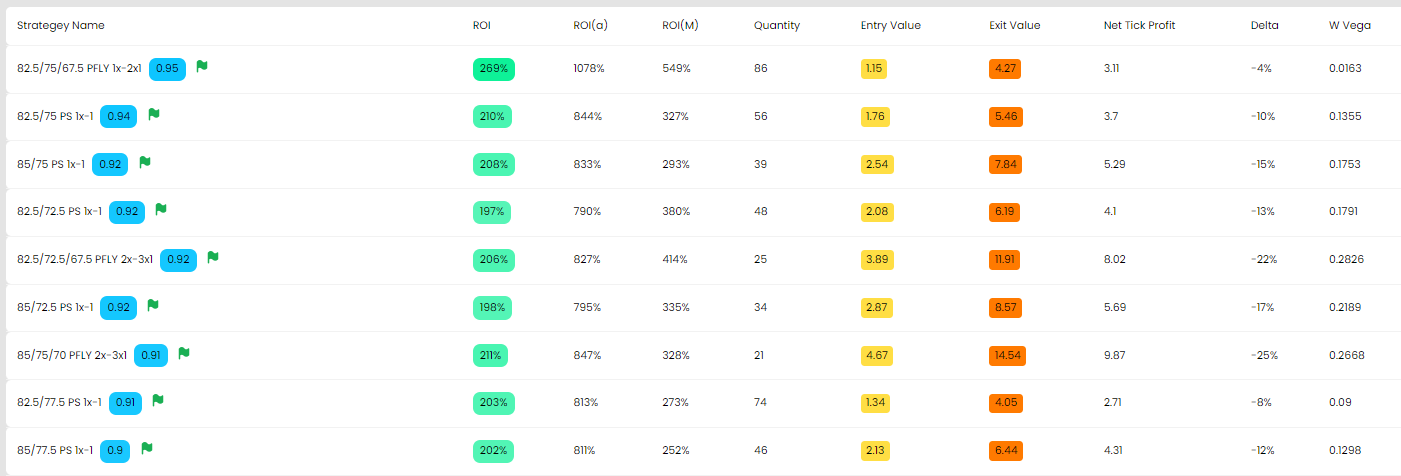

3 months out

3 months out

Got a target range of $73 to $79 as my sweet spot, so what did BB1 come up with?

I am actually going to choose the 2nd on the list, just because it monetizes a lot quicker...so the 82.50/75 put (bear) spread

and as you can see here it looks nice on the heat map

and as you can see here it looks nice on the heat map

Now as I have mentioned before, I am doing this as a pay it forward kind of thing, but I dont intend to do ALL the work for you. So pick a side...UP OR DOWN...you do not have to do both! And as always, remember it is better to be lucky than good, happy hunting..

Darren Krett

Tuesday, 12 March 2024

0

Comments (0)

Darren Krett

Wednesday, 13 March 2024

0

Comments (0)