Darren Krett

Wednesday, 2 November 2022

FOMC ANALYSIS

0

Comments (0)

Darren Krett

Tuesday, 8 November 2022

Share on:

Post views: 18217

Categories

Blog

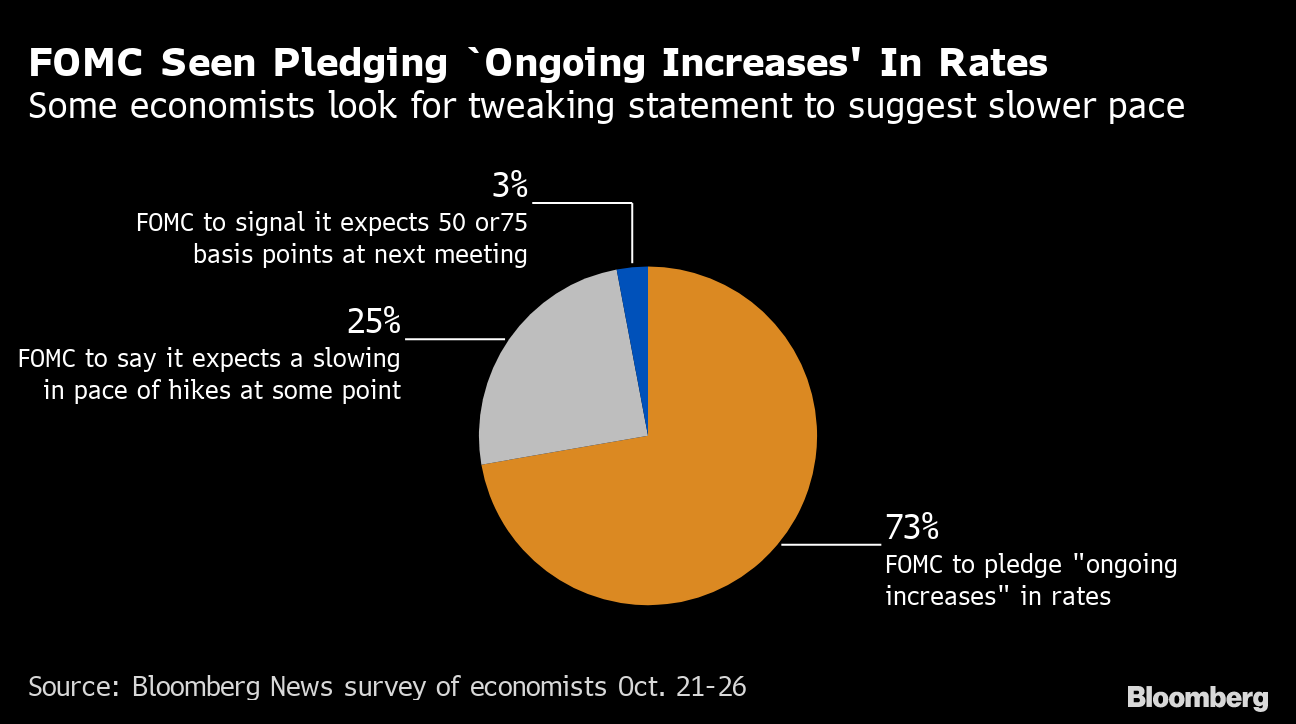

Though Federal Reserve Chairman Jerome Powell was certainly hawkish last week, we don't believe the terminal funds rate expectations should rise much further given the information available and we think long-end Treasury yields are in the process of peaking. Investors consider that a grid-locked government could be good for Treasuries.

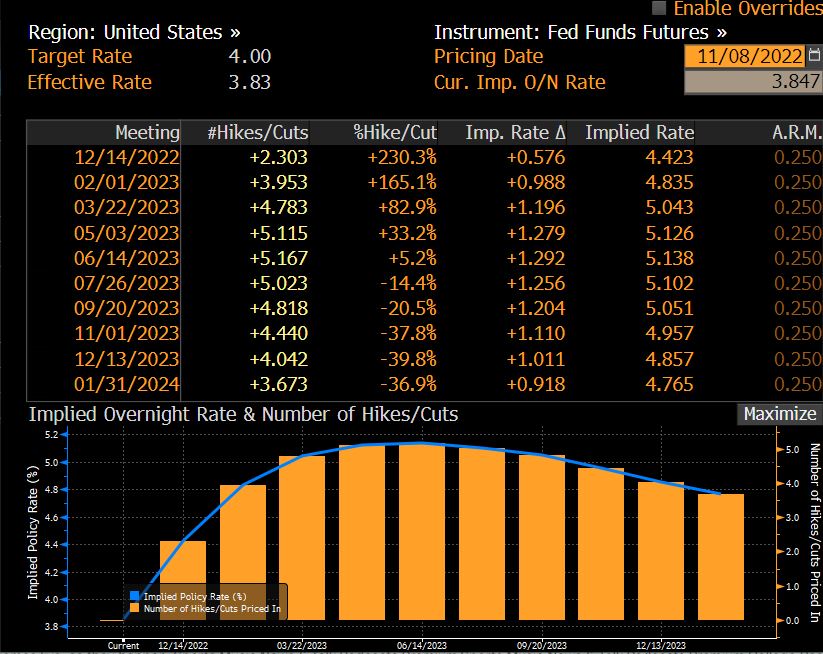

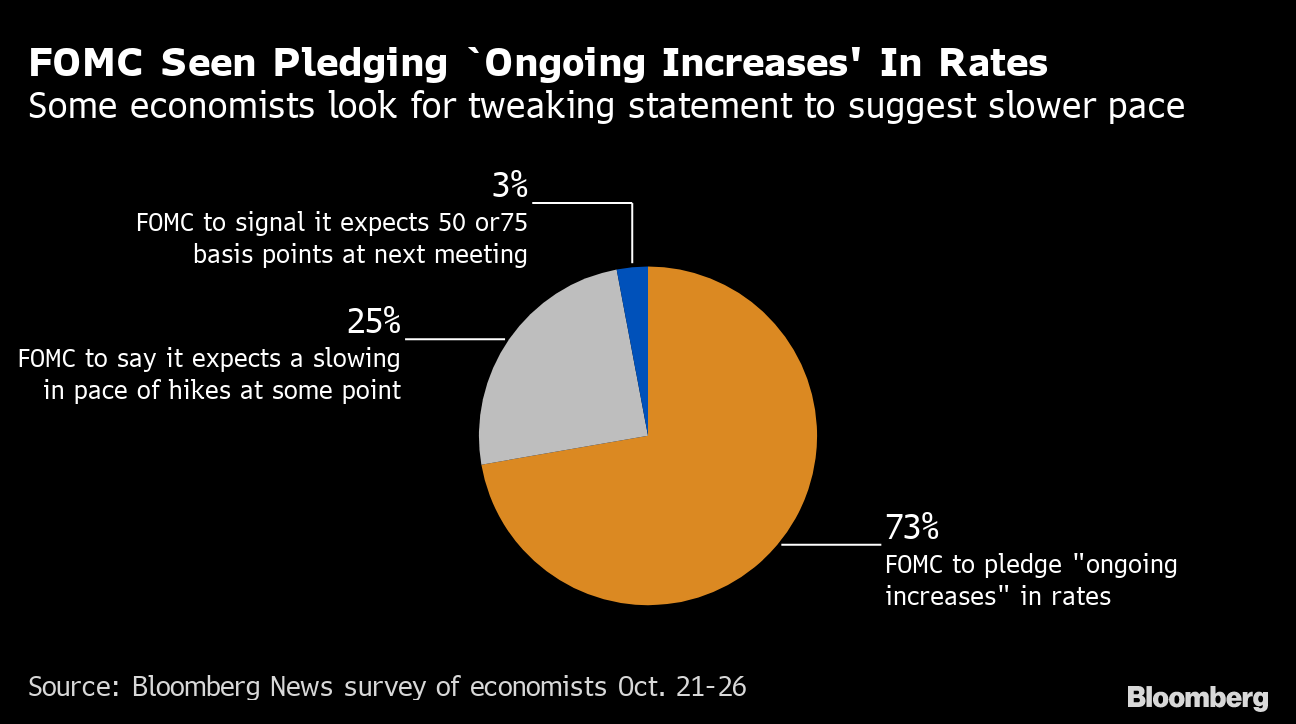

The starting point for Fed Chairman Jerome Powell's higher terminal rate noted at the post-meeting press conference isn't what the market was pricing in, but the Fed's "dot plot." The market is pricing for an additional hike since the meeting, but it's not a given that will occur. What may be more important to the Treasury market is how long the Fed keeps rates at the terminal level. We already believed the Fed would keep rates at the peak for longer than during prior cycles, a view shared by Bloomberg Economics. "Powell is unlikely to repeat [former Fed Chairman Arthur] Burns' mistake of cutting rates sharply into a recession when inflation is still too high," BE says in the linked piece.

If realized, the long end of the Treasury curve may rally as short-term rates lag, leading to bull flattening and additional inversion.

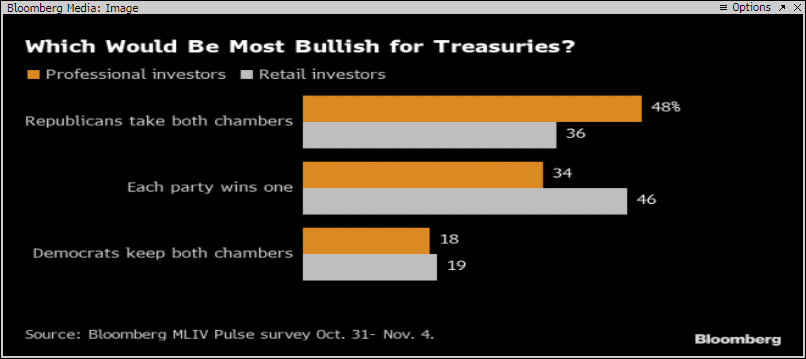

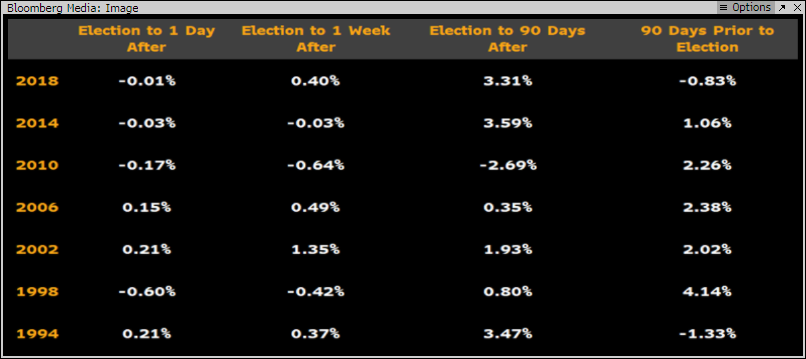

Elections generally, and midterms in particular, tend to have very little effect on Treasury-market returns, even though an MLIV Pulse survey suggested institutional investors believe a Republican Congressional sweep could benefit Treasuries, while retail investors think a split Congress would be most bullish. We've noted in the past that split governments tend to lead to lower deficits as gridlock allows little movement on budgets -- the Covid-19 response being a very notable exception. Yet a split government could lead to another debt-ceiling showdown in 2H23.

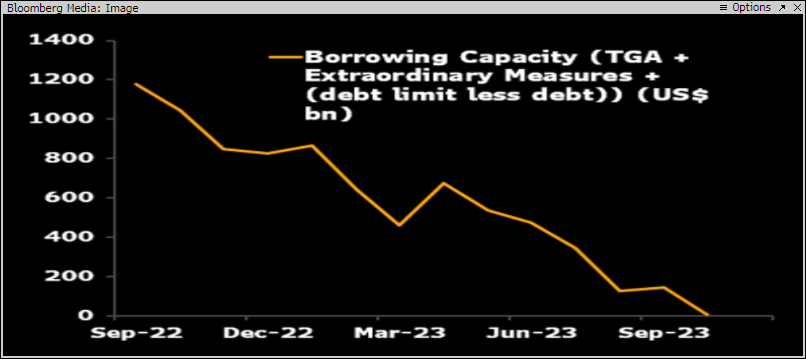

We project the government will run out of borrowing capacity in October of next year, with some variation around that date based on tax receipts and spending early in 2023. After tax day in April, a more precise estimate can be made.

We project the government will run out of borrowing capacity in October of next year, with some variation around that date based on tax receipts and spending early in 2023. After tax day in April, a more precise estimate can be made.

Treasury-Index Performance Around Midterms Midterm elections historically don't appear to have more than a modest impact on the performance of the Bloomberg Treasury index. Returns have been relatively benign for the index in the 1-day and 1-week periods after the election over the last four cycles. The Treasury index posted flat returns following the 2014 and 2018 elections, but there were strong rallies in the 90 days after the election that weren't election related.

Even in 1998, which saw the largest 1-day move after a midterm election over the past two decades, the selloff wasn't particularly large.

The Bloomberg Economics team expects deficits of $940 billion and $1 trillion in the next two fiscal years, which will push the debt ceiling squarely into focus toward the end of 2023. As of Sept. 30, we calculate the Treasury department had just under $1.2 trillion in total funding capacity, which included $200 billion under the current statutory debt limit, $335 billion of extraordinary measures, and $636 billion in cash. Over time, issuance to fund the deficit will cause the Treasury to use cash out of its account at the Federal Reserve (the TGA), plus not increase T-bill issuance.

We assume Congress will wait until the last minute to raise the debt limit once again, meaning 2a7 money funds may maintain and increase balances in the Fed's reverse repurchase agreement facility until late 2023.

Darren Krett

Wednesday, 2 November 2022

0

Comments (0)