Closing Report

Darren Krett

Wednesday 3 May 2023

END OF DAY REPORT MAY 3rd

FED raises rates 25bp, as expected and nobody really cared and yet the market still prices in a cut by September

END OF DAY REPORT MAY 3rd

0

Comments (0)

Darren Krett

Tuesday 9 May 2023

Share on:

Categories

closing report

Fed's Williams (voter) says he is confident Fed is on right path to lower inflation to 2% target; will be data dependent; very focused on impact of tighter credit conditions on economic outlook Still sees inflation falling to 3.25% in 2023 and 2% by 2025 (as he said back in April). Still sees unemployment rate rising to 4.0-4.5% this year. Inflation pressures remain "too high". Core services inflation stripped of housing remains persistent, running at 4.5% since last August, "it will take the longest to bring down". Expects economy to grow modestly this year (prev. said he expects under 1% growth this year). Reiterates job growth remains robust amid signs of slowing demand for workers. Fed's Williams (voter) says Fed has not said it is done raising rates; Fed has made "incredible progress on monetary policy" Will raise rates again if needed. Don't see any reason to cut rates this year. Not seeing a wage-price spiral today. Structural shifts will not impair the Fed's work to return to the inflation target. Possible US economy has more underlying strength; risks to both up and downside. Seeing signs of further tightening of credit; expects credit contractions will affect economic growth. Doesn't see tighter credit knocking the economy totally off course. Tighter credit may blunt how far the Fed goes with rate hikes. Wage growth has slowed, but has now stabilised at a high level, suggesting labour market is still very strong. Acute phase of banking stress is likely over. House Speaker McCarthy tells NBC he will reject any White House effort at a short term debt limit lift to align calendar with budget negotiations. “Let’s just get this done now.” Fed's Jefferson (voter) says banking system is "sound and resilient"; banks have started to raise lending standards, that is typical for where the US in the economic cycle Inflation has started to come down, the economy has started to slow in an orderly fashion. Inflation will come down while economy continues to grow. ECB's Nagel says interest rates should rise further, via FAZ; he could have imagined a 50bp increase (re. May), though overall thinks the decision was "okay" as the ECB announced further hikes and they will reduce the balance sheet more from July When questioned on why the ECB didn't stick with 50bp: "The important thing is that we don't take a break.... But now the size of the step is no longer as important as it was last year..." On recent banking crisis: "... of the opinion that this is not a systemic crisis". Adding, "I have not significantly revised my assessment of inflation downwards as a result. And that is crucial here." Not worried about German banks, they are in "good shape". Current level of rates is not yet high enough to keep prices stable. Adding, once we have reached this interest rate level, we will probably have to remain there for a while. The market is not always right (re. terminal rate), has been overly optimistic on inflation in recent months. Price stability is the top priority in everything. At the G7, will address the talks which are needed for new global precautions to offer some protection for banks if affected by rumours of distress. White House says short-term debt limit extension is not our plan; meeting with Congressional leaders will stay focused on avoiding default on US debt fed's Williams says he is seeing signs tighter credit conditions is affecting the economy, he will not speculate how the Fed would navigate a debt ceiling breach Commercial Real Estate Valuations may understate pressure in the sector. Monetary policy is focused on the economy, there are other tools to deal with financial stability.

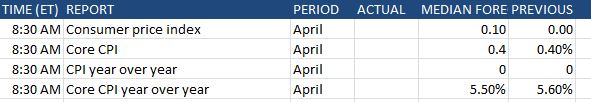

As President Joe Biden prepares to host a much-anticipated meeting on the U.S. debt ceiling with the country’s four top lawmakers, analysts are predicting there won’t be a deal yet on this issue and the best case outcome would be to kick the can down the road again to give congress more time to come up with a solution. meanwhile, Tight lending conditions and loans refinanced at higher, unsustainable rates could potentially stifle construction and development inm commercial real estate, which is something we have discussed (and probably will again) before. IF there is any canary in teh coalmine then commercial real estate is it.With $1.5 trillion in loans maturing in the next two years, developers and landlords need more time to restructure and repay debt and banks need to hope that their mortgage portfolios arent revalued at market price or we will see more failures. And then tomorrow you have CPI to look forward to as the battle between inflation Vs credit crunch/debt limit continues....

| Ticker | Event | Release Date | Range Last Time Out | Range Move Average | Max Move | Min Move | Volatility Previous Day | Volatility Day Of | Volatility Move | Volatilty +1 day |

|---|---|---|---|---|---|---|---|---|---|---|

| S&P | CPI | 5/10/23 | 64.25 | 125 | 222 | 64.25 | 17.06 | 16.92 | -0.14% | 16.02 |

Darren Krett

Wednesday 3 May 2023

0

Comments (0)

Darren Krett

Thursday 9 March 2023

0

Comments (0)