HIGHLIGHTS

An unknown drone has crashed in the vicinity of Kolomna, Moscow Region, according to Mash cited by Faytuks

Earlier, the Russian Kremlin said it foiled a drone attack on President Putin's presidential residence. Subsequently, Russia said Moscow reserves the right to take retaliatory measures as it deems appropriate in response to the attempt to target the Kremlin, according to Sky News Arabia

Russia Parliament speaker demands Kyiv regime be destroyed after the drone attack on the Kremlin

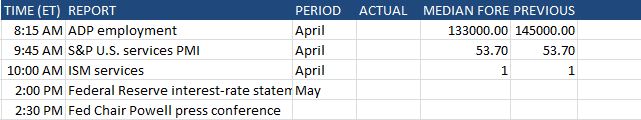

Federal Reserve hikes rates by 25bps to 5.00-5.25% as expected

opens door to rate hike pause, drops language it anticipates more policy firming may be appropriate to attain sufficiently restrictive stance In determining extent to which additional policy firming may be appropriate, it will take into account tightening to date, policy lags and other developments.

US Banking system is sound and resilient.

Tighter credit conditions likely to weigh on the economy, hiring and inflation. Job gains have been robust, inflation remains elevated.

Will continue reducing balance sheet as planned. Vote was unanimous

Fed Chair Powell says focus remains on dual mandate, we are committed to bringing inflation back down to 2%

Fed Chair Powell says activity in housing sector remains weak, labour market remains very tight, there are some signs that supply and demand in labour market are coming back into better balance, nominal wage growth has shown some signs of easing

Fed Chair Powell says we will take a data dependent approach to determine extend of further rate hikes

Fed Chair Powell (Q&A): Says decision on a pause was not made today, statement change today was meaningful today, will be driven by incoming data and meeting my meeting

Fed Chair Powell says we are prepared to do more if it is warranted, remain committed to bringing inflation back down to 2% goal

Fed Chair Powell (Q&A): Hard to predict how much credit tightening will replace need for any further rate hikes; assessing the extent to which firmer policy will be needed will be ongoing and meeting by meeting Credit tightening complicates that assessment and adds uncertainty.

FED Fed Chair Powell (Q&A): Says many banks are now attending to liquidity, financial stability tools and monetary policy tools are working well together

Fed Chair Powell (Q&A): Debt ceiling did come up in discussion and they talked about debt limit issue as a risk to the outlook, but it was not important in today's policy decision

Fed Chair Powell (Q&A) says staff forecast is independent of Fed policymakers and says the forecast from Fed staff was for a mild recession, staff forecasts at this meeting were broadly similar to March forecasts

Fed Chair Powell (Q&A) when asked about what they will be looking at between now and June, says a particular focus now and going forward is what is happening with credit tightening