HIGHLIGHTS

US Senate Majority leader Schumer says democrats' position on debt limit remains the same on the need to pass a clean bipartisan increase in government borrowing limit

US Senate Majority leader Schumer gives second reading to competing Debt Limit bills this morning, preparing them for potential votes. 'Clean, bipartisan' Senate bill only option to avoid default, Schumer says, according to Bloomberg's Ognanovich

Regional banks plummeting as short sellers circle, weighing on market, lifting Treasuries There has been no particular catalyst for the tumble in the regional banks Tuesday with losses accumulating gradually from the open, but mainly after JOLTS job openings data entered the rear view.

The sell-off Tuesday is permeating more broadly across regionals, rather than specific banks at risk as policymakers had initially hoped, although it's noteworthy that PacWest and Western Alliance are leading the losses, two banks that have recently been under scrutiny. Large cap banks are still being sold, although not as acutely, with JPMorgan "the lender of second to last resort", the outperformer.

The First Republic takeover was a story for Monday, but the broader questions on the sector's future remain. Short sellers appear to be actively targeting the regional banks now with questions over increasing funding costs and the sector being on the precipice of a regulation overhaul.

Some have also expressed concerns over the lack of guarantees for blanket deposit insurance.

One potential weight is the growing traction around Charlie Munger's interview with the FT over the weekend, who warned that regional banks were "full of" bad commercial property loans.

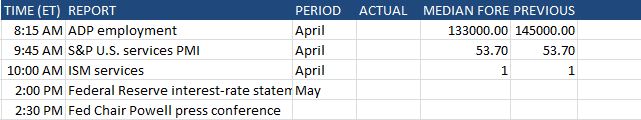

The concern now for policymakers is contagion, and it's worth highlighting that WSJ's Timiraos wrote on Monday that the Fed would be assessing the market's reaction to the FRC takeover ahead of its rate decision on Wednesday. Thus, it's of little surprise to see some of the hike pricing unwind in money markets, with a 25bps hike now priced at 80% probability vs 95% earlier today.

Similarly, haven demand and lower Fed rate expectations are seeing Treasuries rip higher, being led by the front-end.

Wells Fargo CEO says consumers and businesses are still remarkably strong; sub-prime customers are struggling a lot more Loan delinquencies are going up slowly.

Knows that things are going to slow because of Fed rate hikes. Should not even be talking about debt ceiling. Expects weakness in office commercial real estate loans to play out over time. Is "all for" raising level of FDIC insurance premium but would not go too far.

Banks should not subsidize all the ills of other banks. Does not think the solution is to have everything insured.

Marginally tightening up lending where you would expect. Bank not making a meaningful pullback in credit availability. Regional banks are not all the same.

Former Treasury Secretary Mnuchin says we are going to see inflation come back to 3-4% range pretty quickly