END OF DAY REPORT MAY 25th EQUITIES, FUTURES & OPTIONS

HIGHLIGHTS

US President Biden says himself and House Speaker McCarthy have had several productive conversations on debt ceiling and it is time for Congress to act now;

Biden put forward proposal to freeze spending for two years. Negotiations are about budget outlines. McCarthy and him have a very different view of who should bear the burden of additional efforts to get our fiscal house in order.

Will not agree to huge cuts on teachers, police, border patrol agents or increase wait times for social security claims. Believe they'll come to an agreement.

BoE's Haskel prefers to lean against risks of inflation and further UK rate rises can't be ruled out;

as difficult as current circumstances are, embedded inflation would be worse Higher business profits are not driving inflation.

Labour market in the UK is still very tight. While some indicators suggest that the labour market is loosening somewhat, he views it as still very tight in an absolute sense.

Data shows little evidence of UK inflation being disproportionately due to firms raising prices. Believe it is prudent to reduce the focus we place on forecasts of the medium-term and put more weight on the near-term data

ECB's Knot (hawk) says no sign that underlying inflation is abating and ECB will hold rates at peak for significant time; need rate hikes of 25bps in June and July but is open minded on September

Belarus President Lukashenko says transfer of non-strategic nuclear weapons from Russia to Belarus has already begun, according to TASS

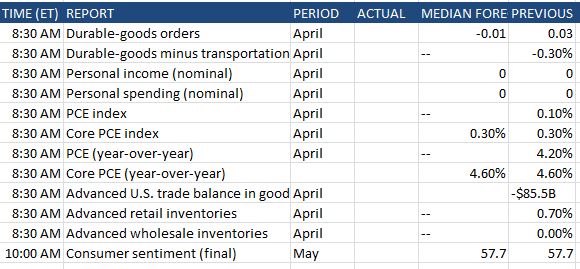

Fed's Collins (non-voter) says baseline outlook does not hold for significant economic downturn; would not be surprised by modest increase in unemployment; inflation decline has been slower than expected

SUMMARY

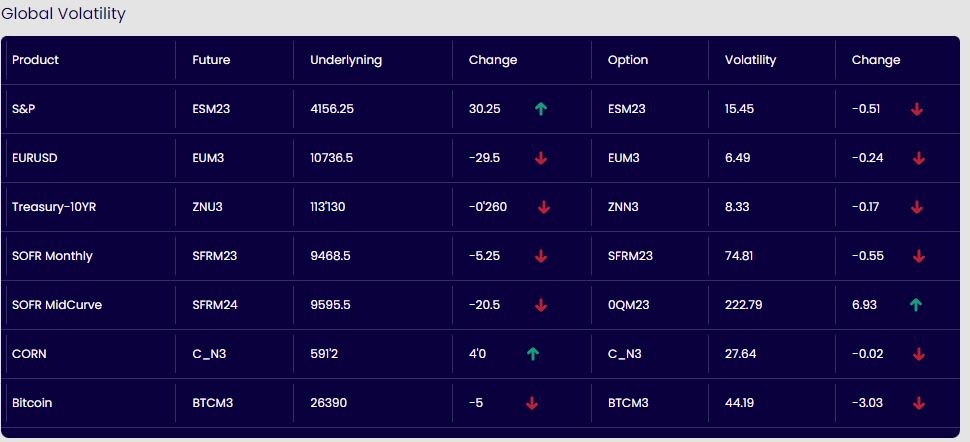

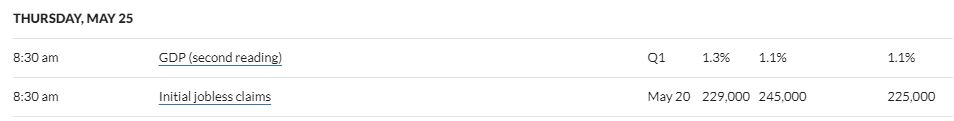

As a deal on the debt ceiling seems immanent, stocks rallied firmly although not quite back to the recent highs yet. Focus will shift to tomorrows PCE number (the Fed's favorite gauge) to see if there are more rate hikes on the way