END OF DAY REPORT EQUITIES, FUTURES & OPTIONS MAY 15th

HIGHLIGHTS

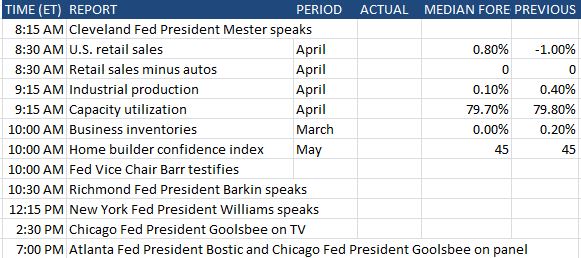

FED Fed's Goolsbee (voter, dove), in a CNBC interview, says need to monitor more than normal data sets and need to be attuned to credit; a lot of the impact of rate hikes is still in the pipeline Does not feel like a 2008-type of crisis but it feels like stress in some parts of the financial sector. Effect of banking stress on GDP is not small, need to take it into account and sit and watch it. Should be extra mindful, want to get inflation back to target path without starting a recession. Trying to figure out where we are in the business cycle, which looks like no other. May rate hike was a close call due to the question mark about credit conditions.

SEC Chair Gensler says SEC isn't currently weighing stock short-selling ban

US President Biden has scheduled a debt limit meeting with US House Speaker McCarthy for Tuesday, will be meeting with congressional leaders on Tuesday

Fed's Bostic (non-voter), in Bloomberg TV interview, says he doesn't rule out anything as far as rate hikes, got to keep a possible rate hike on the table for sure; if were voting now for June it would be a vote to hold Still a lot of data before June. Have been at restrictive policy for six-to-eight months, would now expect to start seeing the effects of tightening. Pricing power is not nearly as clear as it has been; that's very positive

US House Speaker McCarthy says he is not confident of getting a deal this week based upon what they are offering right now

FDIC Chair Gruenberg says banking industry is quite resilient during recent stress, according to prepared testimony Early reports show aggregate bank net income is roughly unchanged in Q1 2023, ex recent acquisitions.

SUMMARY

Despite a generally well-received earnings season and signs that easing inflation may allow the Federal Reserve to halt its monetary-tightening cycle, worries about a technical government-debt default and recent banking-sector anxiety, credit issues, commercial property are enough to restrains the bulls. With stagflation risks still on the table, any incoming inflation data which shows pricing pressures remaining sticky will make the markets grow nervous that the Fed will keep rates higher for longer and that only a shock or a faceplanting economy will allow the Fed rhetoric and the actual currently implied yield curve, to converge.