END OF DAY REPORT EQUITIES, FUTURES & OPTIONS MAY 10th

HIGHLIGHTS

A minor miss on CPI vs consensus in y/y headline inflation, but a marked market reaction alludes to the fact that a 4% handle may have caught the eye

EU antitrust regulators are set to approve Microsoft's acquisition of Activision Blizzard (ATVI) next week with May 15th as the likeliest date, according to Reuters sources

UAE's Royal Group is shorting US stocks amid global recession fears, according to Bloomberg

Alphabet (GOOGL) CEO says Google is integrating generative AI into search; as expected, announces Palm 2 AI model

ECB's Centeno says in "monetary policy in terms of fixing key rates is at the maximum of this cycle"; an interest rates adjustment is still underway

White House says CPI report is progress but a default is the biggest threat

Alphabet (GOOGL) surges over 4% on its AI-focused product event

SUMMARY

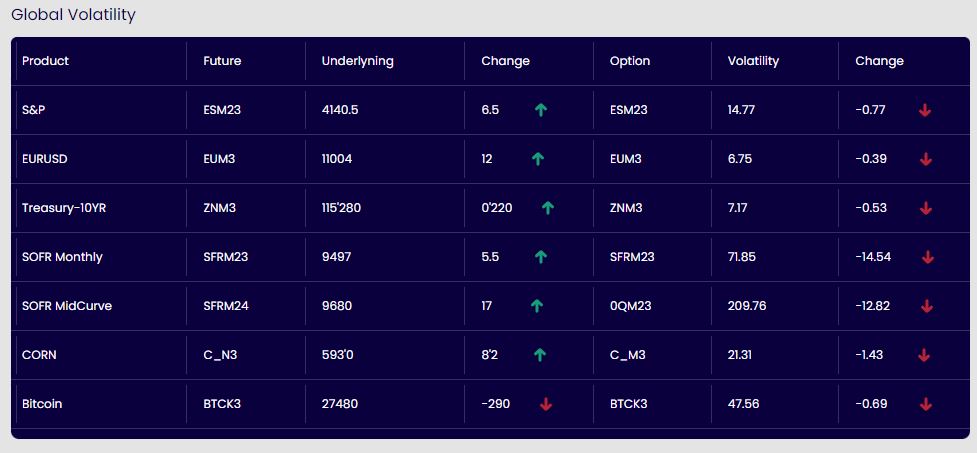

So initial reaction was positive to the headline CPI having a “4” handle in it, which saw stocks rally along with Treasuries and SOFR. But some aggressive bull flattening saw stocks turnaround and go lower before a positive reaction to Alphabet’s (Google) AI focused product event and McConnell stating that he convinced a deal will be done in regards to the debt limit saw us return to small positive on the day.

However, the rates market does not paint such a rosey picture as we are now pricing in 40bp of cuts by September & 87bp of easing by year end ! This seems very “optimistic” IMO.

Seems like we are winding up for a big move, with the S&P ranges getting tighter and tighter…todays CPI range was the smallest we have seen since March 2021 with the 5 day rolling average only 19points.