END OF DAY REPORT MARCH 3rd

HIGHLIGHTS

- Russian President Putin has reportedly ordered set rules for defense companies under martial law

- ECB's de Guindos believes headline inflation will continue to decline, and around mid-year it could fall under 6%; says however core inflation could have a more stable performance

- Russia plans to mothball damaged Nord Stream gas pipelines amid little prospect of relations improving between Russia/West; both lines conserved to prevent degradation, according to Reuters sources

- EU official says it would be absolute red line if China provided weapons to Russia and would respond with sanctions

- Fed's Logan (voter) says markets are falling behind on ability to support Treasury market during stress; central bank interventions should be rare given they are complex and require trade offs

SUMMARY

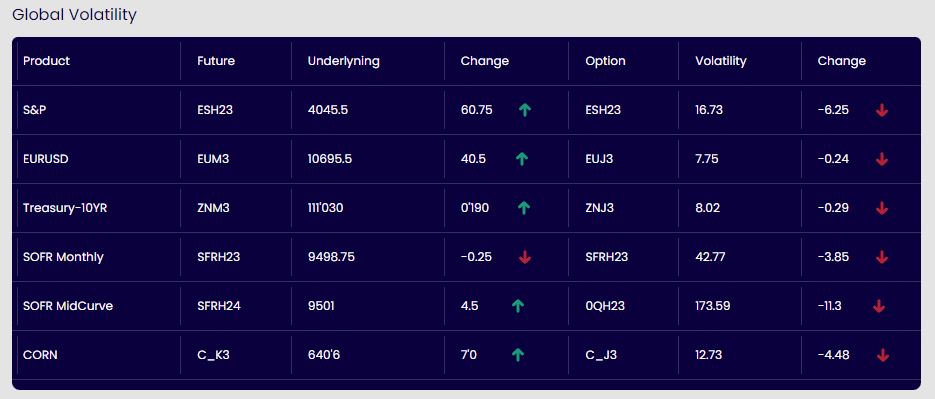

A hectic run-in to month end and first few sessions of March, dominated by the ongoing rout in debt markets that propelled yields even higher and the entire US Treasury curve beyond 4% at one stage.

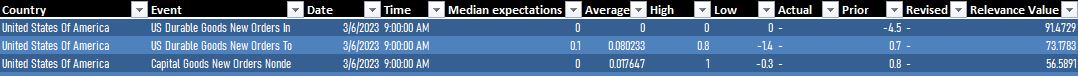

However, the 10 year benchmark lost a bit of upside momentum after peaking or peeking just over 4.09% (3.9733% currently) and the long bond never really gleaned any traction above the psychological level to the detriment of the Dollar and benefit of risk sentiment in general. In fact, the DXY reached its pinnacle on Monday within a 105.359-104.094 range amidst mild-to-moderate buy signals from a couple of bank rebalancing models and was flagging on the last trading day of February until a late bounce from the aforementioned low that was attributed to residual end of month demand. The Greenback was undermined by a weaker than forecast Chicago PMI and surprise deterioration in consumer confidence, but regrouped over the next two sessions with assistance from hawkish comments made by Fed’s Kashkari and Waller, plus much hotter than expected prices paid in the manufacturing ISM, a sharp upward revision to Q4 unit labour costs (double consensus and almost three times above the preliminary estimate) and another dip in weekly jobless.

On the equity front, stocks are ending the week on the front foot, having shown a lot of resilience in the face of the rate moves (s&p up 1.5% at time of writing) and technically looking like we could be in for a bounce, but this will all depend upon the moves in the rate market. If you haven't yet mapped the S&P to the 5s Vs 30s yield curve you may be in for a bit of a surprise, but we will talk about that another time......