END OF DAY REPORT JUNE 16th

HIGHLIGHTS- EQUITIES, FUTURES & OPTIONS

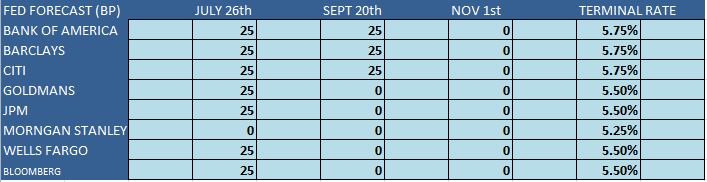

Fed Governor Waller says changes in credit since SVB failure are in line with what was happening before that due to Fed rate hikes, it is still not clear recent bank failures had a material effect on credit conditions Mon pol and financial stability tools are separate and distinct, with one acting broadly and the other more surgical. Policy should not be altered due to ineffectual management at a few banks. Fed's job is to use monetary policy to fight inflation, job of bank leaders is to deal with interest rate risk

Fed Governor Waller says that right now, everything "seems to be calm" in the US banking system March bank turmoil was not like 2007/08 when assets were toxic. US economy is still "ripping along". Anticipated global spillovers from coordinated central bank tightening have not really materialised. Could be short run price impacts of things such as re-shoring production but should not imply ongoing inflationary price increases. Reliance on forward guidance means that the policy lag is not the same as it used to be; makes conditions tighten faster

ECB President Lagarde says very likely that ECB to continue to hike rates in July; after July, will follow a data dependent approach Inflation projected to remain too high for too long.

Fed Biannual Monetary Policy Report: Inflation well above target and labour market very tight Bringing inflation down likely to require a period of below-trend growth, some softening of labour market conditions. Some indicators of future business defaults are somewhat elevated. Core services ex-housing inflation has not shown signs of easing. Reiterates negative income has no impact on its activities. Outlook for funds rate subject to "considerable uncertainty". Will adjust the pace of the balance sheet contraction if needed. March banking system turmoil reportedly left an imprint on bank lending conditions, especially for mid-sized and small banks

SUMMARY

The AI theme might mean that returns for both Stocks and Bonds could end up in the upper part of the predicted range

For now, the AI theme has remained confined to Equities and it has also been orthogonal to broader risk markets.

But, aside from shorter term speculation which has remained an Equity theme, the impact of AI could become broader and extend to other sectors and the rest of the economy.

If this follows the pattern of a technology/productivity shock, this may well end up boosting margins, raise productivity, and lower inflation over the 3Y to 5Y horizon.

This should undoubtedly help stocks but the silver lining of lower inflation for defensive investors is that fixed income expected returns should also increase, softening the blow of not being bullish enough on the Equity market.