HIGHLIGHTS- EQUITIES, FUTURES & OPTIONS

FOMC MEDIAN FORECASTS

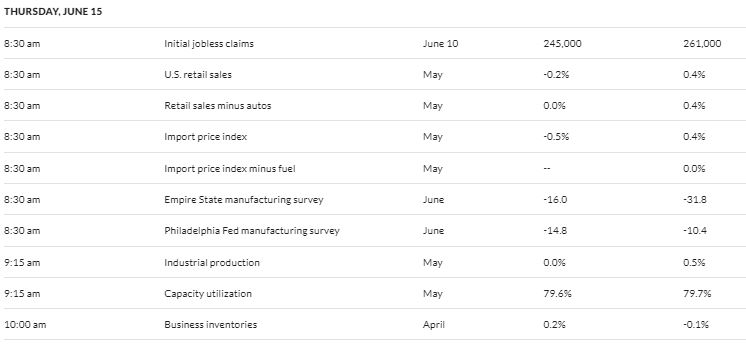

FEDERAL FUNDS RATE: 2023 5.6% (exp. 5.1%, prev. 5.1% in March), 2024 4.6% (exp. 4.4%, prev. 4.3%), 2025 3.4% (exp. 3.1%, prev. 3.1%), longer run 2.5% (exp. 2.5%, prev. 2.5%).

CHANGE IN REAL GDP: 2023 1.0% (exp. 0.6%, prev. 0.4%), 2024 1.1% (exp. 1.2%, prev. 1.2%), 2025 1.8% (exp. 1.9%, prev. 1.9%), longer run 1.8% (exp. 1.8%, prev. 1.8%).

UNEMPLOYMENT RATE: 2023 4.1% (exp. 4.2%, prev. 4.5%), 2024 4.5% (exp. 4.5%, prev. 4.6%), 2025 4.5% (exp. 4.5%, prev. 4.6%), longer run 4.0% (exp. 4.0%, prev. 4.0%).

PCE INFLATION: 2023 3.2% (exp. 3.3%, prev. 3.3%), 2024 2.5% (exp. 2.5%, prev. 2.5%), 2025 2.1% (exp. 2.1%, prev. 2.1%), longer run 2.0% (exp. 2.0%, prev. 2.0%).

CORE PCE INFLATION: 2023 3.9% (exp. 3.7%, prev. 3.6%), 2024 2.6% (exp. 2.6%, prev. 2.6%), 2025 2.2% (exp. 2.1%, prev. 2.1%)

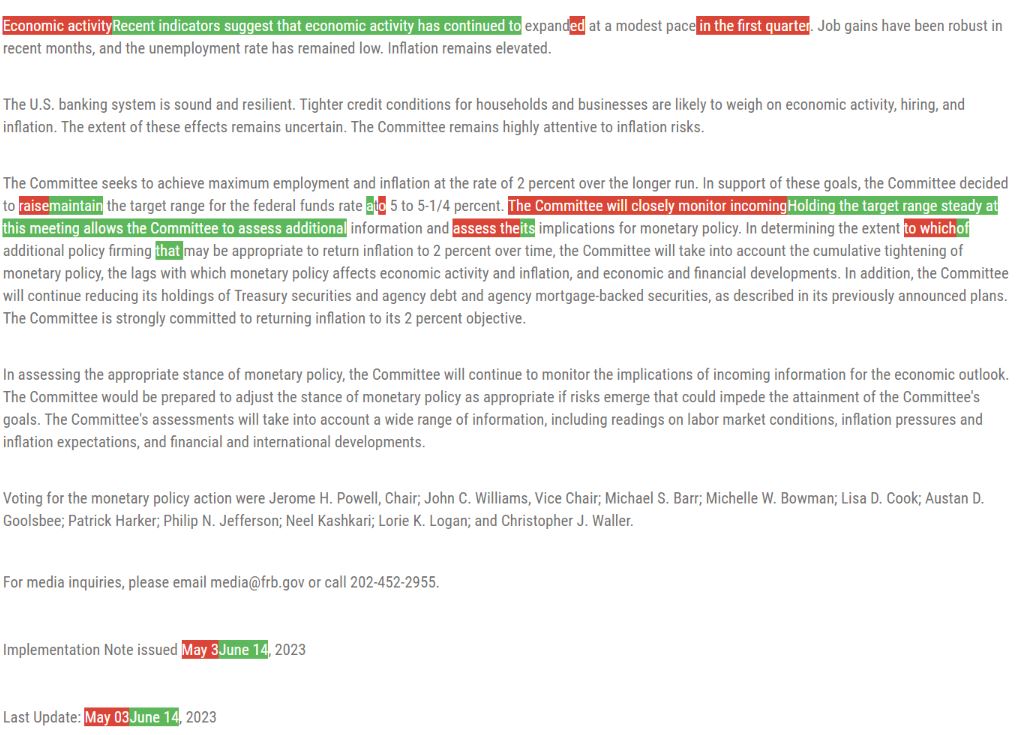

Fed Chair Powell repeats Fed is strongly committed to the 2% inflation goal, without price stability we will not achieve a sustained period of strong labour market conditions Have covered a lot of ground and full effects of tightening are yet to be felt.

Fed Chair Powell says inflation remains well above 2% goal and inflation has moderated somewhat; inflation pressures continue to run high Getting inflation back to 2% has a long way to go. Highly attentive to risks high inflation poses to both sides of mandate.

Fed Chair Powell says at this meeting, considering how far and fast we have moved they judged it prudent to hold rates steady

Fed Chair Powell (Q&A) says question of speed on rate hikes is separate from question of level of rates; we are not so far away from destination on Fed funds rates It is reasonable to go slower as we approach rates destination. Most policymakers thought it is reasonable to adjust to a slower pace. We do not know full extent of banking turmoil consequences. We are trying to get this right. By July rates decision will have three months worth of data, will look at it all, the outlook and make the decision in July

Fed Chair Powell (Q&A), calls the decision a "skip", before correcting himself "should not call it a skip"

Fed Chair Powell (Q&A) says we see housing putting in a bottom, maybe moving up a bit, will see rents filtering into housing services inflation

FED Fed Chair Powell (Q&A) says I would not say it is likely to make changes to ONRRP rate in the near-term

FED Fed Chair Powell (Q&A) says Fed will monitor market conditions carefully as Treasury refills TGA, starting at a very high level of reserves, do not see reserves becoming scarce over the course of the year

FED Fed Chair Powell (Q&A) says we are not seeing a lot of progress on Core PCE, want to see it moving down decisively, want to get inflation down to 2% with minimum damage to the economy In 2021, inflation was coming from strong demands for goods, in 2022 and now in 2023, many analysts believe getting wage growth down is important for getting inflation down. Source: Newswires 13:55 FED Fed Chair Powell (Q&A) says when we see inflation flattening, and softening, we will know what tightening is working; by taking a little more time on tightening, we reduce chance of going too far 13:51 FED Fed Chair Powell (Q&A) says I can't tell you I ever have a lot of confidence where the Fed Funds Rate will be far in advance; we have moved much closer to sufficiently restrictive 13:50 FED Fed Chair Powell (Q&A) says labour market has surprised with extraordinary resilience

SUMMARY

The Fed left rates unchanged at 5-5.25% as expected, but crucially, ramped its 2023 rate dot forecast 50bps to 5.6% from 5.1% (range of dots for 2023 rate shifted up to 5.1-6.1% from 4.9-5.9%), with many expecting just a 25bps increase, firmly keeping the "skip" narrative on the table.

The 2024 dot was raised to 4.6% from 4.3%, 2025 raised to 3.4% from 3.1%, but the longer term 'neutral' rate left at 2.5% (albeit the central tendency of the estimates increased to 2.5-2.8% from 2.4-2.6% amid speculation around now being in a higher equilibrium rate regime).

The rosy assessment of the economy was accompanied by the statement commentary reiterating that the banking system is "sound and resilient" whilst continuing to acknowledge that the extent of the effects of tighter credit conditions remains uncertain. The copy-paste statement from early May implied a lack of evidence seen amongst the Fed of any material credit contraction in the six weeks gone by, emboldening the upgraded economic forecasts