Morning Report

Darren Krett

Monday 12 June 2023

MORNING MINUTE JUNE 12th

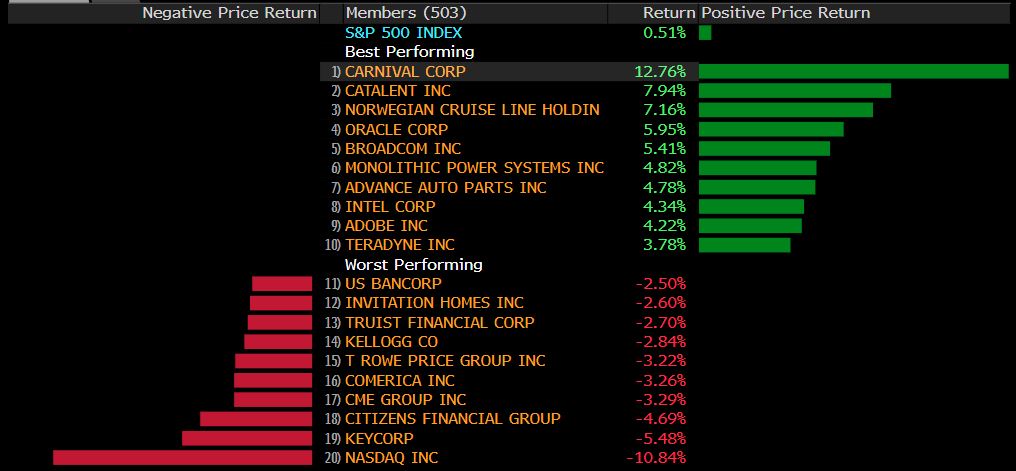

No economic numbers today, so expect a quiet one as we await CPI tomorrow and the Fed meeting on Wednesday

MORNING MINUTE JUNE 12th

0

Comments (0)

Darren Krett

Monday 12 June 2023

Share on:

Categories

closing report

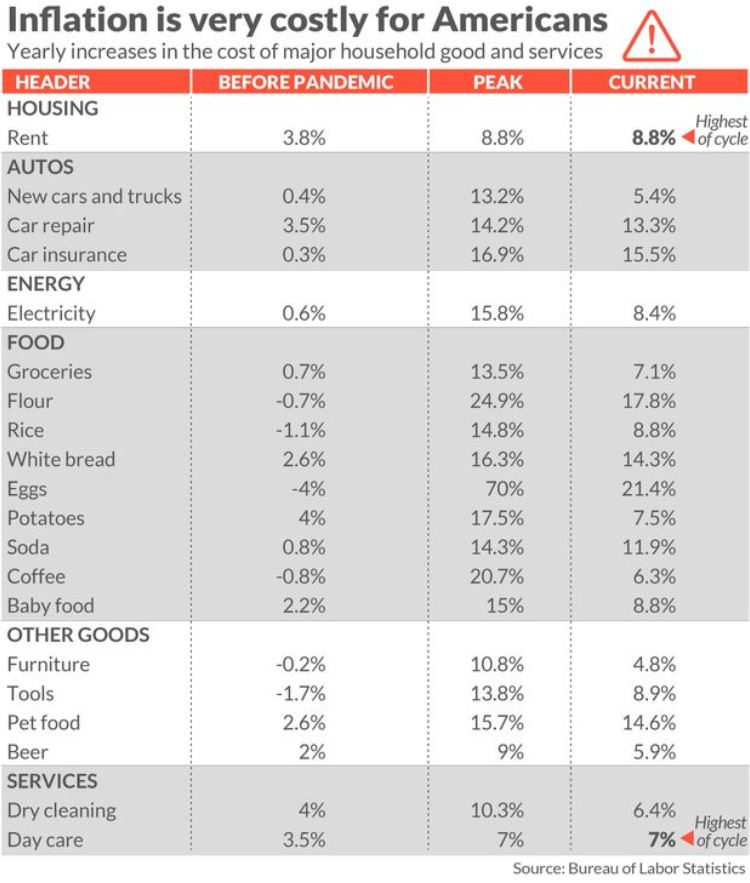

The US is reportedly preparing evacuation plans for US citizens living in Taiwan amid “heightened level of tension”, according to sources cited by The Messenger; “The fact that the US is doing this doesn't mean that they expect there will be a war" "The planning has been underway for at least six months and “it’s heated up over the past two months or so,”" “The fact that the U.S. is doing this doesn't mean that they expect there will be a war. It’s only a statement that there could be a war.” Former Fed Vice Chair Clarida says going to see less policy support during downturns in the future; central banks showing signs of QE fatigue May be more difficult to get inflation near 2% than in the past 15yrs because of supply shocks. UN Chief Guterres says they are concerned Russia will quit Black Sea Grain deal next month Bank of America (BAC) CEO Moynihan says on CNBC that economy is slowing down; Fed should take a pause, but can't say we are done yet Sees current rate environment holding then cutting next year. Inflation is still too high relative to the 2% target. Capital markets will get back on track and open. Seeing credit line usage flatten out. Sees the economy slowing down, middle market line-usage is flat. Would consider a bank deal through the FDIC process. Banks are in great shape, and are "out there making money". Poland says NATO should respond to Russia moving nukes to Belarus NY Fed May Consumer Survey: Median 1yr-ahead inflation expectations fall to 4.1% (prev. 4.4%), 3yr rises to 3% (prev. 2.9%), and 5yr rises to 2.7% (prev. 2.6%) Labor market expectations were mixed with expected earnings growth declining, and unemployment expectations and perceived job loss risk improving. Households’ perceptions and expectations for credit conditions and their own financial situations deteriorated slightly.

The markets and many economists expect the Federal Reserve to keep rates unchanged this week while keeping the door open for a hike as soon as the next meeting in July — a “hawkish pause” that some Fed officials are calling a “skip.” Will the Fed nail down expectations of another hike or try to keep more optionality? Will the central bank reinforce that this is a “skip?” And will the divisions within the Fed be seen? We will write up expectations after the CPI tomorrow….

Darren Krett

Monday 12 June 2023

0

Comments (0)

Darren Krett

Wednesday 12 April 2023

0

Comments (0)