Morning Report

Darren Krett

Wednesday, 5 July 2023

MORNING MINUTE JULY 5th

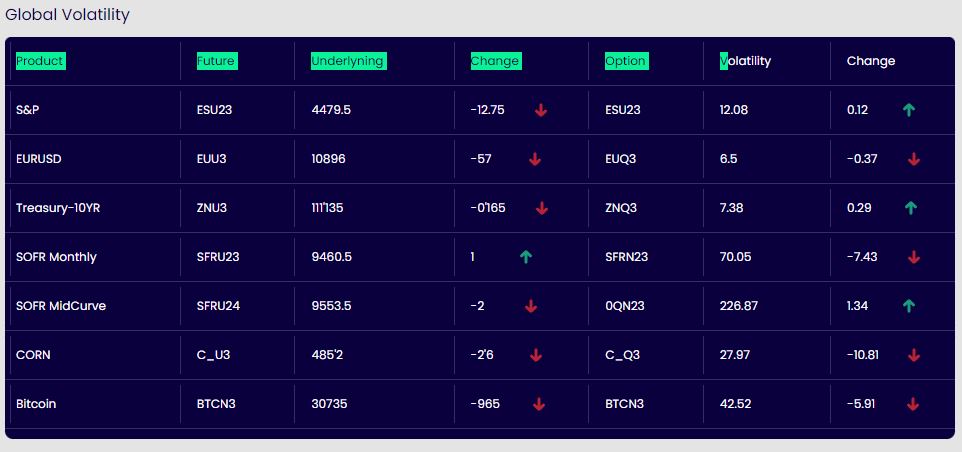

WEAKER PMI DATA OUT OF CHINA AND EUROZONE SEND STOCKS WEAKER AS WE AWAIT THE FED MINUTES TO GAUGE IF MORE RATE HIKES ARE COMING

MORNING MINUTE JULY 5th

0

Comments (0)

Darren Krett

Wednesday, 5 July 2023

Share on:

Categories

closing report

FOMC MINUTES: Almost all judged it appropriate or acceptable to leave the target rate unchanged Most of these participants observed that leaving the target range unchanged would allow more time to assess the economy's progress toward the Committee's goals of maximum employment and price stability. Some participants indicated that they favored raising the target range by 25bps at this meeting or that they could have supported such a proposal. The participants favoring a 25bp increase noted that the labor market remained very tight, momentum in economic activity had been stronger than earlier anticipated, and there were few clear signs that inflation was on a path to return to the Committee's 2% objective over time. All participants continued to anticipate that maintaining a restrictive stance for monetary policy would be appropriate to achieve the Committee's objectives. Almost all participants noted that in their economic projections that they judged that additional increases in the target federal funds rate during 2023 would be appropriate. Most participants observed that uncertainty about the outlook for the economy and inflation remained elevated and that additional information would be valuable for considering the appropriate stance of monetary policy. Many also noted that, after rapidly tightening the stance of monetary policy last year, the Committee had slowed the pace of tightening and that a further moderation in the pace of policy firming was appropriate in order to provide additional time to observe the effects of cumulative tightening and assess their implications for policy. Participants agreed that their policy decisions at every meeting would continue to be based on the totality of incoming information and its implications for the economic outlook as well as the balance of risks. They also emphasized the importance of communicating to the public their data-dependent approach. Most participants observed that post-meeting communications, including the SEP, would help clarify their assessment regarding the stance of monetary policy that is likely to be appropriate to bring inflation down to 2% over time. Outlook Fed staff saw a mild recession as likely, the same as the May minutes. Almost all participants stated that, with inflation still well above the Committee's longer-run goal and the labor market remaining tight, upside risks to the inflation outlook or the possibility that persistently high inflation might cause inflation expectations to become unanchored remained key factors shaping the policy outlook. Some participants commented that there continued to be downside risks to economic growth and upside risks to unemployment. Despite the receding of the stresses in the banking sector, some participants commented that it would be important to monitor whether developments in the banking sector lead to further tightening of credit conditions and weigh on economic activity . Some participants noted concerns about the potential risks stemming from weakness in commercial real estate. A number of participants observed that the resolution of the federal government debt limit had removed one source of significant uncertainty for the economic outlook. A few participants noted that there could be some upward pressure on money market rates in the near term as the Treasury issued more bills to meet expenditures and return the balance in the TGA to the Treasury's preferred level. Those participants observed that upward pressure on money market rates relative to the rate offered on the ON RRP facility could lead to a decline in usage of the facility.

Darren Krett

Wednesday, 5 July 2023

0

Comments (0)

Darren Krett

Monday, 5 June 2023

0

Comments (0)