Morning Report

Darren Krett

Wednesday 12 April 2023

MORNING REPORT APRIL 12th

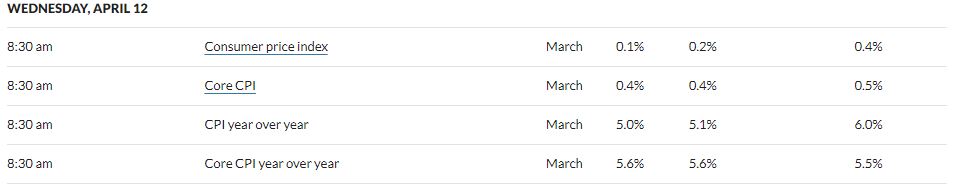

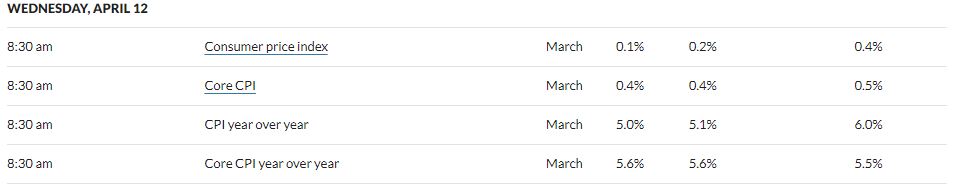

All is quiet as we await CPI number along with the Fed minutes, what will the Fed do with rates? all will be revealed

MORNING REPORT APRIL 12th

0

Comments (0)

Darren Krett

Wednesday 12 April 2023

Share on:

Categories

closing report

Warren Buffett says more banks may fail, but he’s willing to bet $1 million that depositors won’t lose money March CPI report shows U.S. grocery prices falling for the first time since 2020 Fed's Barkin (2024 voter) says the CPI report was pretty much as expected, via CNBC; certainly past peak inflation but there is still a ways to go Demand Definitely see demand cooling, watching this and lags ahead of the May meeting. Looking very hard at demand, labour market and inflation. Credit card spending for March gives some comfort that demand is cooling Inflation Has particular focus on core inflation, still more to do there. View is that the Fed reacts to inflation as it comes in, re. rate path. (in the context of the BoC pausing) says if you want to get inflation back to target, you need multiple months where it is headed there. Trend lines matter, need to get back to the inflation goal. Fed's Daly (non-voter) says bank stresses have stabilised; expects inflation to end 2023 a little above 3% (vs March SEP Core PCE median at 3.6%) Inflation expectations are anchored, allowing the Fed to take a couple of years to bring down inflation. Policy tightening is at a point now where Fed doesn't expect to continue to raise rates at every meeting. There is a sense Fed will get rates up to a level and stay there. Don't want to forecast the end of a tightening cycle. Had good news today on inflation. Will look in CPI inflation to see if core services ex-housing is coming down. Getting signs of cooling in labour market, but not there yet; how far away from "there yet" is why we watch the data. There is a lot of uncertainty about how long it takes for rate hikes to impact the economy. There's a lot more in the pipeline of monetary policy tightening FOMC MINUTES: Participants left rate projections unchanged from December after taking into account banking sector stresses; Many lowered views of rate peak on bank strains Prior to banking stresses many had seen the appropriate policy path as being somewhat higher than in December. Pre-meeting data indicated slower than expected progress on inflation. Fed staff projected a mild recession starting later in 2023. Participants agreed there was little evidence pointing to disinflation for core services excluding housing. Banking sector developments likely to result in tighter credit conditions and weigh on activity, hiring and inflation. ECB's Villeroy says inflation has become more broad-based, core inflation is still strong and core inflation is proving sticky and has become potentially more persistent

So some of the Fed officials were a little spooked by the bank strains and did indeed change their vote from 50bp and looking through the minutes, came across as fairly dovish. The heavy focus on banking turmoil that was underway during the Federal Reserve's March meeting means the minutes could be a bit outdated.looks like there is enough to suggest that another hike at the May meeting is likely, particularly since banking stress appears to have abated. Though the Fed will want to keep options open, I think it will pause come the June meeting, which could continue recent Treasury-yield curve steepening as the market prices for interest-rate cuts in the future.

Darren Krett

Wednesday 12 April 2023

0

Comments (0)

Darren Krett

Tuesday 11 April 2023

0

Comments (0)