HIGHLIGHTS

FED: Mester (non-voter) said the PCE data on Friday confirms inflation is still too high and it underscores slow progress and suggests the Fed has more work to do. On the June meeting, she noted everything is on the table but she may have to revise up her inflation forecasts although she will not prejudge the outcome, noting there is still more data ahead of the June FOMC. She also added her path for the funds rate is to raise and hold there for some time. She noted prior rate hikes will affect the economy going forward, and tighter policy is still feeding into the economy and she still supports an FFR of over 5%. Mester added she has not seen much sign that banking stress is affecting credit conditions, but the focus right now is on tightening credit standards, although she does not know exactly how tight policy is right now, it is important the Fed does not undertighten. She also suggested she considers herself an "owl", not a hawk or a dove. On the economy, she said it has slowed quite a bit relative to last year, but it is still resilient.

DEBT CEILING: Heading into the memorial day holiday, the Republicans and the White House appear to be coming closer to a deal, albeit the primary progress was seen Thursday evening. Reports via Politico suggest the two sides have all but finalized the spending portion of discussions. Meanwhile, an official said President Biden and House Speaker McCarthy are near a deal that would raise the debt ceiling for two years and cap spending on most items, other than military and veterans. The official added Biden and Democrats are considering scaling back a boost in IRS funding as part of a budget deal. Given it is a Memorial Day holiday, reports suggest negotiators will be staying in the Capitol to get a deal done over the weekend ahead of the June 1st X-Date. A WH official said a deal is possible on Friday, but it could easily slip into the weekend. However, GOP negotiator Graves said the WH has expressed strong concerns about Medicaid in the talks, warning they continue to have major issues that they have not bridged the gap on and slams Dems for not accepting more work requirements, according to Punchbowl; said “Hell no” he won’t drop these demands in a final deal. GOP negotiator McHenry said that there has been progress in talks, but it becomes more difficult as progress is made. McHenry added a deal needs to be made in the next day, or two, or three.

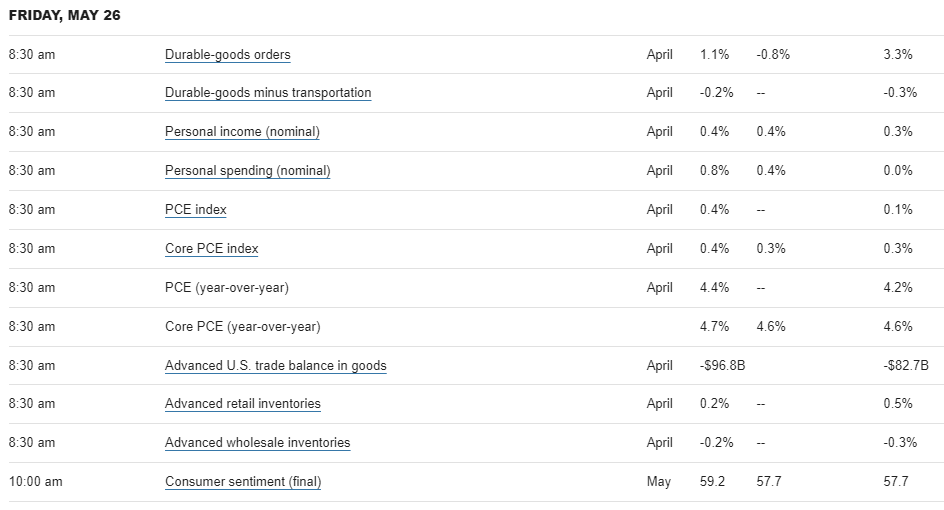

DATA PCE: The PCE data was hot. Core PCE rose 0.4% M/M, above the expected 0.3% and accelerating from the prior 0.3%, while the Y/Y accelerated to 4.7% from 4.6%, despite expectations for another 4.6% print. The headline rose 0.4% from 0.1% M/M and the Y/Y rose to 4.4% from 4.2%. The hot inflation prints will be key for the Fed's June decision, with recent commentary leaning towards a "skip" but with an option to hike if necessary. The acceleration of the Fed's preferred gauge of CPI will help the case for the hawks, and money markets are now looking at a near 60% probability of a 25bps hike in June. There is still more data to digest between now and the June 14th FOMC, including next week's NFP, and the May CPI and PPI data on the 13th and 14th June, respectively with the CPI and PPI within the FOMC blackout period. Personal income rose 0.4% from 0.3%, in line with expectations while consumption rose 0.8%, above expectations of 0.4% while the prior was revised down to -0.1% from 0.0%. Real consumer spending rose 0.5% vs 0.3% expected. Analysts at ING write this will inevitably lead to upward revisions of Q2 GDP expectations given the large weighting of consumer spending within the GDP report.

SUMMARY

Stocks grinded higher on Friday heading into the long Memorial Day weekend albeit it is worth noting futures volume was at the lowest seen this week given the recommended early closure. The large-cap Tech, Consumer Discretionary and Communication names did a lot of heavy lifting with NDX surging 2.6% while the SPX saw gains of c. 1.3%. Helping the NDX outperformance was the continued strength post-NVDA on Thursday, but also after strong earnings from Marvell (MRVL) Thursday night, buoying the semi sector overall. On the debt ceiling, there was some optimism, albeit a deal is still yet to be reached but there was some clear progress on Thursday evening, but sticking points remain and there has been little progress since. The stock rally appeared to look through the hotter-than-expected PCE report which also resulted in a marked hawkish re-pricing with money markets now looking for an over 60% probability of a 25bp hike in June while just 6bps of cuts are being priced in through year-end. The repricing led to pronounced curve flattening. The data helped bring the dollar index off lows but DXY was unchanged on Friday and remained above 104 while EUR/USD kept its head above 1.07 and USD/JPY rose above 140.