Bryan Fitzgerald

Thursday 2 March 2023

Share on:

Post views: 3242

Double Digit Fed Funds?

Categories

Interest Rate

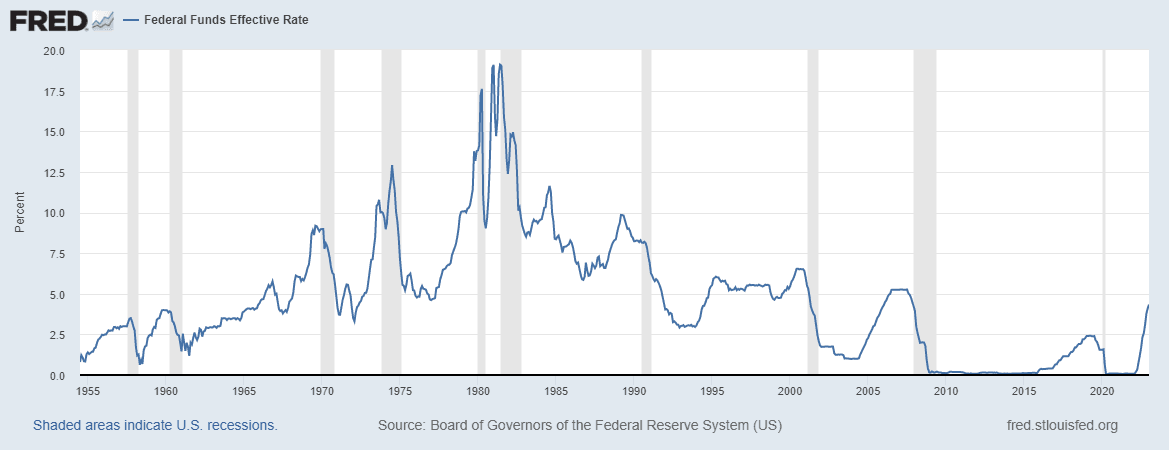

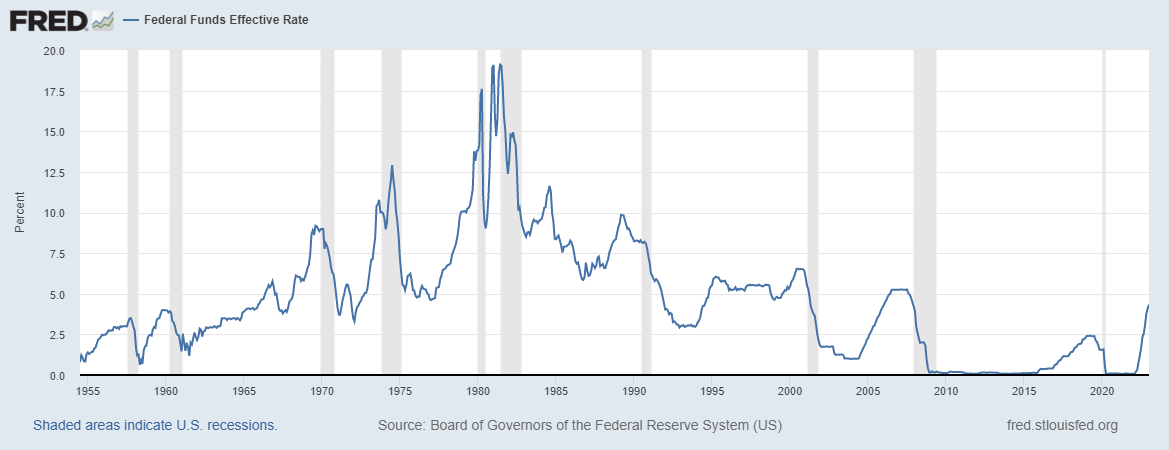

It is all about interest rates. Commodity prices, equity prices, real estate prices, volatility, and asset prices in general are all tied to a relatively obscure decision made by a group of men just praying that they can bring the economy to a soft landing. Is it possible? Of course, it is possible. Is it probable? The odds are in the same ballpark as the Cubs, Bears, Bulls, and Blackhawks all being champs this upcoming year. It’s an extreme long shot to say the least. The main questions must be: “how high are rates going to go?”, “how will asset prices perform with higher rates?”, “can the world economy handle higher rates?”, and finally “will it be enough to slow down inflation?” All of these questions warrant their own investigation and are each important in their own right, but for my purposes they are all the same all the same question: How high can rates go? In short, they will go as high as they need to go. There are so many inputs going into how we get to a terminal rate that we can’t just assume 5.5, 6%, or even 8% will be enough to achieve the goals of the FOMC. The goals may change, but for now they are 2% inflation and full employment. “Disinflation” was all the talk of the February FOMC, but that talk quickly took a back seat as the inflation data picked up again and payrolls jumped. It matters not that most economic data has not been great and personal debts are skyrocketing with government debts. The mandate is clear and as much as we may want to postulate about the broader economy and asset prices, inflation and employment are the only two things to focus on for the time being. The FOMC will have to see inflation moving lower, for longer, than they are currently seeing. Throughout history, interest rates below 2% have led to excessive speculation. This is true for as long as records have been kept. Excessively low interest rates have led to boom and then bust cycles. Some have been short, and others have been prolonged. History may never repeat, but it sure is similar. Populations do not like their money to sit idly by so they invest said money and leverage themselves by buying assets on credit if they are not getting a return on their money. Credit fuels the speculative euphoria until….Boom. Most recently, rates were brought below 2% in 2002 after the 2001 attacks. This led to bubbles is real estate, equities, and commodities. Of course, the house of credit came falling down just six years later. The following charts show the exuberance from 2003 to 2009 in S&P and Wheat. These are prime examples of how the speculative bubbles form under a low rate regime. We could also show the Energy complex, Soft Commodities, all Grains, and real estate to illustrate as bubbles formed in all. These bubble all formed with rates below 2% for only three years.

We have had a zero interest rate policy, worldwide, for basically a decade before inflation started to surface. To think that it could be tamed without drastic consequences would be naïve. I have zero clue what these consequences may turn out to be, but I am sure this experiment of ZIRP will be taught in economics classes and history classes in the future. As we can see, asset prices have started to come down some since the FOMC started raising rates. However, the charts are comparatively different in scope as the following charts show.

It almost feels as if the equity market correction has barely begun considering the extreme rate cycle. Following is how Volatility performs. It goes from low and steady as the bubbles grow, then boom! Volatility explodes higher.

We have seen some pick up in Volatility since the FOMC embarked on their rate hiking cycle, but not to the extremes when bubbles burst. Most volatility was provided by the Covid response worldwide in early 2020.

For the past year, economists have been debating what the rate should be. They have been proven to be too optimistic in the Feds ability to stem inflation time and time again. This will not be an easy process as this has been the historical pattern. We have already seen the inflation numbers pick up in the US and some European countries after a brief pullback. This will be an extremely delicate process for the committee. If they go in too soft, inflation may soar. If they go in to hard, they can crack the stability of the economy. Remember, there is quadrillions in derivative risk out there that are primarily denominated in US Dollars. These risks will have to be financed in a higher Dollar at a higher rate. That shell game will not go on indefinitely. I do not know how far the FOMC has to raise rates. I do not know the path they will have to take to get there. For all I know, they may pause with every flat line in inflation. Or they may try to stay ahead of it and keep moving incrementally higher. Or they may take drastic steps. However, I do feel that they are not close to being done in this process. At this stage, it would not surprise me if the Fed Funds rate gets close to double digits. It would also not surprise me if the economy cracks before that. The real uncertainty will be in the path. As you can see, it has never been linear. But it has certainly been cyclical.

Bryan Fitzgerald