Darren Krett

Thursday, 6 April 2023

END OF DAY REPORT April 6th

0

Comments (0)

Darren Krett

Wednesday, 26 April 2023

Share on:

Post views: 3541

Categories

Trends

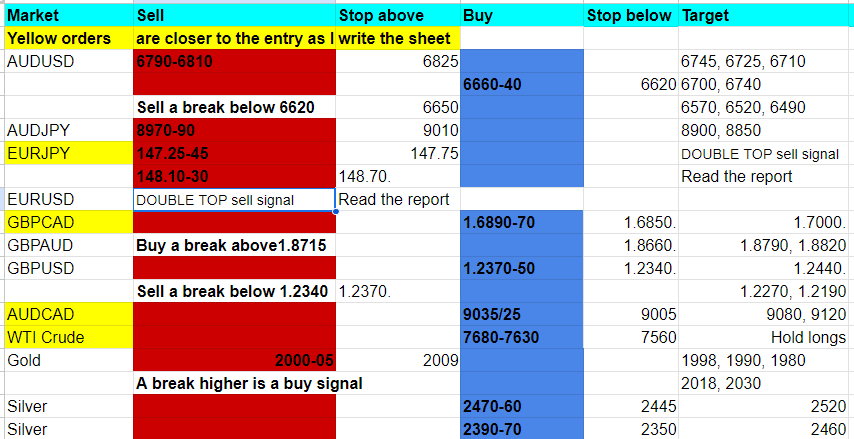

AUDUSD broke support at the lower end of the channel at 6660/40 for a medium term sell signal. So we have resistance at 6640/60 to try a short with stop above 6680. Targets are 6615, 6570 & perhaps as far as 6550.

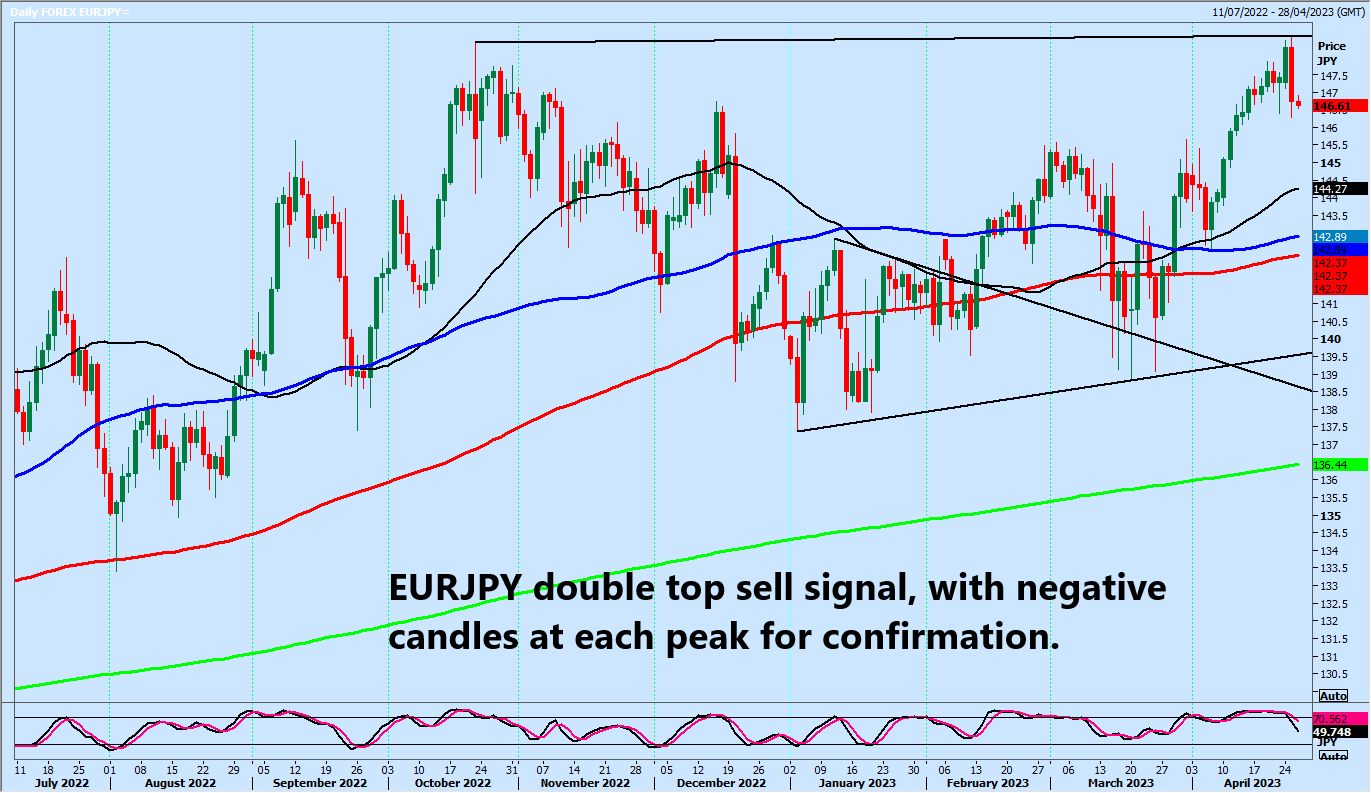

Forex update - EURUSD & EURJPY Double top sell signal!!

AUDJPY broke support at 8920/8900 for a short term sell signal so we now have resistance at 8970/90. Shorts need stops above 9010.

NZDJPY shorts at strong resistance at 8300/8320 worked perfectly yesterday with a high for the day exactly here before we collapsed to my targets of 8260, 8220, 8190 for a very quick 100 pip profit.

CADJPY dropped 200 pips from strong resistance at 100.30/60 so I hope you have managed to run shorts.

We are hitting the middle of the range for the 5 month channel, so it is worth profit taking & waiting for the next opportunity. A small bounce from here is certainly possible but longs need stops below 9765.

AUDJPY broke support at 8920/8900 for a short term sell signal so we now have resistance at 8970/90. Shorts need stops above 9010.

NZDJPY shorts at strong resistance at 8300/8320 worked perfectly yesterday with a high for the day exactly here before we collapsed to my targets of 8260, 8220, 8190 for a very quick 100 pip profit.

CADJPY dropped 200 pips from strong resistance at 100.30/60 so I hope you have managed to run shorts.

We are hitting the middle of the range for the 5 month channel, so it is worth profit taking & waiting for the next opportunity. A small bounce from here is certainly possible but longs need stops below 9765.

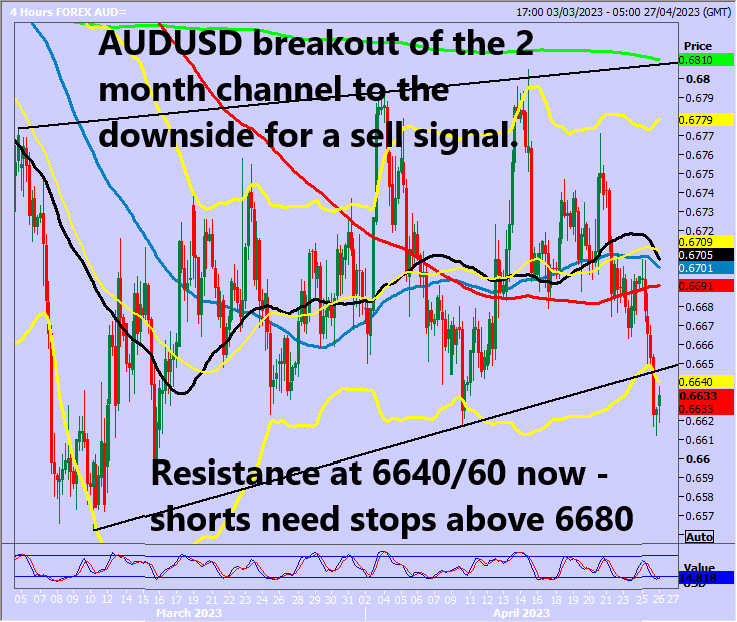

USDJPY up one day, down the next day in the 5 day sideways trend. I will wait for something to happen. We are just drifting at this stage. EURJPY made a new high for the day after beating the October 2022 high of 148.40, so it looked likely the next leg higher in the bull trend had started.

HOWEVER!! the pair swiftly collapsed without any warning & closed below Monday's low to leave a very negative bearish engulfing candle. In fact this candle has buried buyers over the last 2 days, leaving a huge bull trap. This is all the more important because we have a large double top

It is worth trying a short on any bounce today, with stop above 148.70. I would scale in over 2 or 3 prices as it is not easy to know how far a bounce could reach today but I would suggest we have resistance at 147.25/45. A break above 147.75 could tests 148.10/30.

INDICIES: Emini S&P June made a high for the day at first resistance at 4150/60 & we DID tumble from here exactly as predicted. Nasdaq June broke to the downside – although we have seen a strong bounce back, it feels like we will start to head lower. Emini Dow Jones June collapsed from 34000. A move at last. Update daily by 06:00 GMT. Today’s Analysis. Emini S&P June shorts at first resistance at 4150/60 worked perfectly on the collapsed to minor support at 4110/00. Longs are starting to look more risky. A break below 4100 should be an important sell signal in targeting 4075/70 then 4050/40. We can try shorts again at first resistance at 4150/60, Stop above 4175. Nasdaq June broke strong support at 13000/12950, but has bounce back to this area. I think it is worth trying a short on this bounce targeting 12740/700. Stop above 13150. If this trade fails, we could be back in a volatile sideways range. Emini Dow Jones June I thought the 4 month descending trend line at 34000/34100 was becoming less relevant on the sideways consolidation, but if fact we made a high for the day here & finally collapsed. The break below 33800 signals the 4 month trend line has held & is likely to see further losses to at least 33600/580, perhaps as far as the 100 day moving average at 33450 this week. Therefore a break below 33400 should be the next sell signal. Please email me if you need this report updated or Whatsapp: +66971910019

Darren Krett

Thursday, 6 April 2023

0

Comments (0)

Darren Krett

Tuesday, 11 April 2023

0

Comments (0)