Darren Krett

Thursday, 4 May 2023

Share on:

Post views: 2833

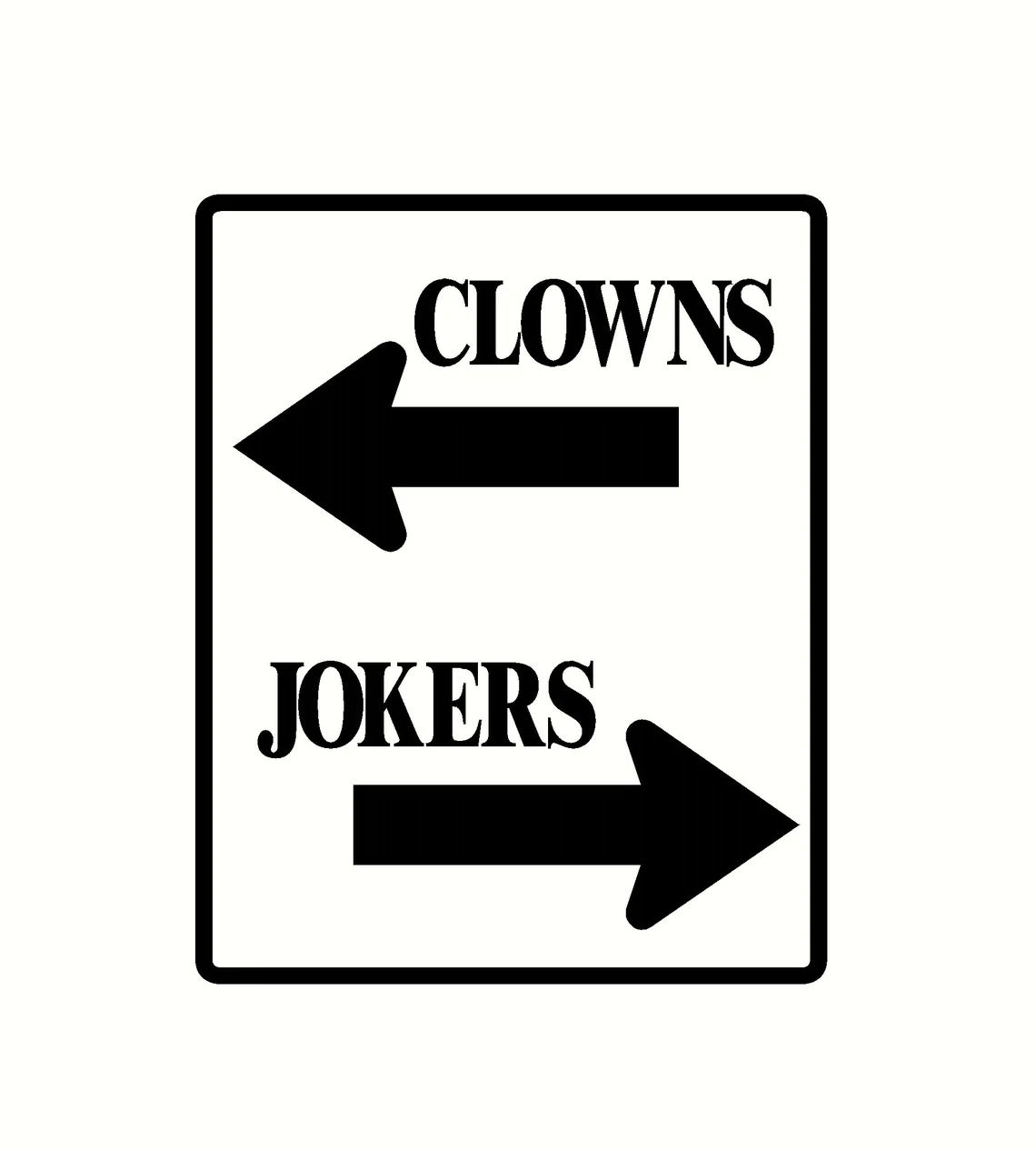

CLOWNS TO THE LEFT OF ME, JOKERS TO THE RIGHT

Categories

Trends

“Markets can remain irrational longer than one can remain solvent”, John Maynard Keynes observed almost 100 years ago, and his view is fitting today.

The recent price action of the financial markets is hard to reconcile. Recession fears are perceptible but economic data is mixed. Take the last two days as the latest example. US job openings declined in March (labour market is cooling) but private employers boosted hiring in April (labour market is tight). Factory orders rose in March and the service sector solidly improved. Headline inflation is mitigated, core inflation is sticky.

The recent price action of the financial markets is hard to reconcile. Recession fears are perceptible but economic data is mixed. Take the last two days as the latest example. US job openings declined in March (labour market is cooling) but private employers boosted hiring in April (labour market is tight). Factory orders rose in March and the service sector solidly improved. Headline inflation is mitigated, core inflation is sticky.

And if this isn’t confusing enough, lets assume that JPOW and the FED are right to stay firm on their “rates higher for longer” and that it is paramount to fight inflation and that this is the way to do it. Well then the yield curve is completely wrong and will offer one of the easiest trades to do in ages.

headwinds sometimes seem to turn into tornados

A US debt default would be the financial equivalent of the Japanese tsunami.… To explain in further detail, the debt limit is the maximum amount of money the US government is able to borrow in order to meet its legal obligations, such as tax refunds, military spending, interest payments on bonds, public servants’ salary and Social Security and Medicare benefits. Since this ceiling does not allow the government to commit itself to new spending once it is reached it must be raised. A failure to do so would force the US government to default on its legal obligations, and would likely result in a financial crisis. A potential default could take shape in one of two forms: technical, which is an extended period of non-payment of some of the US liabilities or actual, in which the government stops paying its obligations, period. The country’s credit rating would get downgraded leading to economic turmoil that would reverberate through the world. Last time it happened in August 2011 equities plummeted 15% in 2 weeks ! Because of the severe repercussions of a possible default the debt limit has always been the tool of political horse-trading, The US Treasury Secretary, Janet Yellen, has warned that the purse might be emptied as soon as June 1 and has urged lawmakers to address the $31.4 trillion limit. The Treasury seeks to increase borrowing by about $726 billion through the end of June. Up until now Congress has always found a consensus to avoid the unthinkable. So, even though there is belief that we WILL sort something out within the next month, to put my faith in the clownshow that is our US congress seems a little…optimistic (?)…In this tug-of-war Republicans are demanding significant spending cuts, reversing student loan forgiveness and green energy tax credits, something the Democrats insist are not negotiable. Yet, pressure is increasing on the administration from business groups to consider the Republican proposal. The longer the issue drags on the more nervous investors become. The exact impact of a default is unknown, it has never happened before, there is no precedent for it. Congressional leaders will meet on May 9

Credit crunch here we come!!

“We are running out of time to fix this problem. How many more unnecessary bank failures do we need to watch before the FDIC, the U.S. Treasury, and our government wake up? We need a system-wide deposit guarantee regime now.” That was hedge-fund billionaire Bill Ackman back with his two cents on the regional-banking system. Banks curtail lending in a credit crunch, making it harder for businesses and consumers — especially those with weaker credit — to acquire loans. The last major credit crunch happened during the financial crisis of 2007-09. With the failure of 4 regional banks since March and with a LARGER amount of assets under management than all the bank failures in 2008 could we soon see a cascade of bank failures?

If you look at the STIRS (Short Term Interest Rate) curve this morning, then it would be a HARD YES, with 40BP shaved off the year end target, implying a slew of rate cuts starting as soon as JUNE!!!!!!!!!

So, is risk on or off? Rates higher or lower? Well,fuck it…Im going to immerse myself in Guardians of the Galaxy 3 and try to forget all this is happening…..