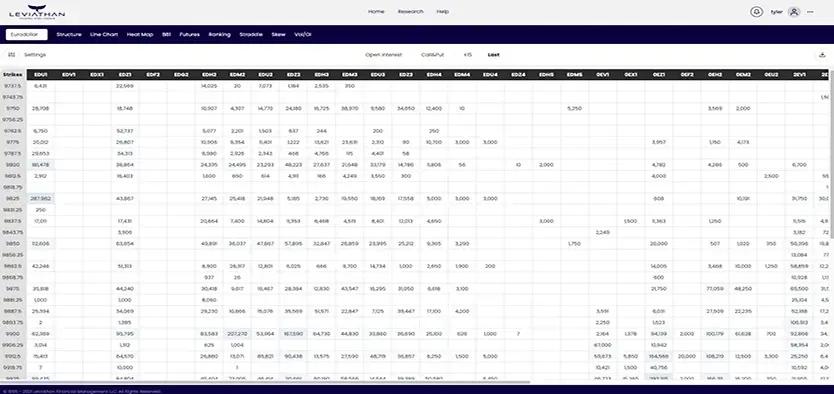

Volume/Open Interest

Dig deep on Open interest

What is Volume/Open Interest?

Volume is the sheer number of contracts that trade in a given strike during a given time period, usually 1 trading session. However, volume can be viewed over longer time periods to give a trader a broader overview of which strikes are the most active. Volume is a good indicator of where interest lies in a given product. For example, if we see heavy Volume in the 1 month 25 delta Put in XYZ then we can garner some information from that. We know that the market participants are either expecting a good selloff in XYZ or they are giving up on that trade and liquidating that position. The Volume report alone does not tell you which of these is true, but the Open interest report does. If OI increases in said XYZ, 1 month, 25 delta Puts, we know that traders are initiating a new position and putting on new risk. The opposite can be said if OI decreases, they are exiting their position and risk. It is important to follow the direction of these trades to determine whether traders are buying or selling these strikes to get a full picture.

What does Volume / Interest tell us?

In a nutshell, Volume tells us which strikes the market participants have interest in trading and OI tells us whether their interest is to add to their position or exit their position. Again, traders need to follow the market closely to gather that last piece of information…direction. Watching the Volume/OI reports closely can help a trader see where option traders are targeting for moves in the underlying, when traders are giving up on said positions, and where the gamma lies. Seeing how the market end users are positioned is very important, but not nearly as important as how the “crowd” is positioned. The market making community is affectionately known as the “crowd”. The crowd is made up of many market makers from a wide variety of firms with very similar risk profiles as they all take pieces of the same customer trades, but they have vastly different risk parameters. Knowing how the crowd is postioned is paramount as the crowd is generally not capitalized in the same way that banks and hedge funds are. In order to keep trading, market makers need to keep their positions hedged to keep margin costs down. This means they need they will inevitably pin their long positions and race through their shorts as they try to hedge their gamma or outright liquidate the option position.

How Can Leviathan Help?

Leviathan separates itself by really digging deep on the Open interest part. A trader can not only watch OI changes on a day to day basis. This would drive someone mad and he would need a computer for a mind to remember it all. Wouldn’t it be more valuable to look at the OI change over the past week, month, or 3 months? Of course it would, the picture is so much clearer as to what traders are doing over a longer time frame. One thing will always remain constant in trading. As new information comes in, traders will adjust their views. As they adjust their views, they will adjust their positions. Leviathan’s VOI helps you follow these position adjustments over longer time frames and also keep up as to where the weak hands of the crowd lie.