Vols & Range Predictor

Immediate insight into how volatility

What is straddle?

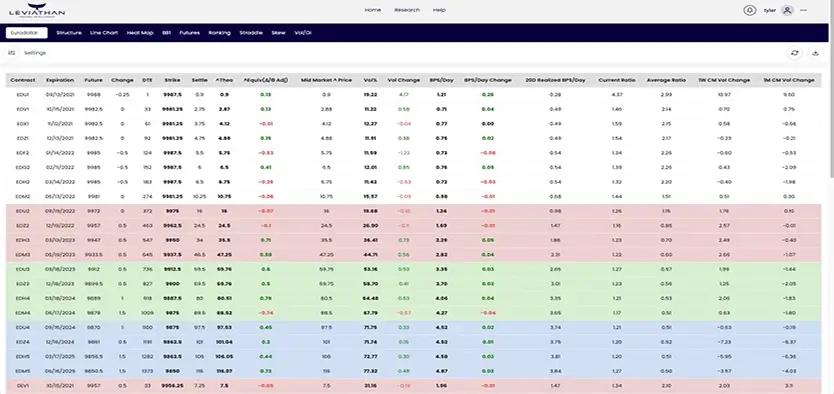

Our unique straddle page gives you a live update on what At-The-money volatility, adjusting as the markets move and analyses any given market and every single month. The straddle page displays changes on the day, week and month, the program not only evaluates 20 day realized volatility but using our proprietary volatility analyzer, Leviathan can evaluate true linear fitted ATM volatility Vs historical and where that ratio has sat to give you a genuine idea of whether volatility is cheap or expensive.

How does the straddle program help a trader?

Volatility is simply the amount the stock price fluctuates, without regard for direction. As an individual trader, you really only need to concern yourself with two forms of volatility: historical volatility and implied volatility. Implied volatility is a dynamic figure that changes based on activity in the options marketplace. Usually, when implied volatility increases, the price of options will increase as well, assuming all other things remain constant. So when implied volatility increases after a trade has been placed, it’s good for the option owner and bad for the option seller. This information is necessary when evaluating trades and it can be difficult to keep an eye on multiple option markets simultaneously. This is one of the many things Leviathan can do for you.

How can Leviathan help with straddle analysis?

Our customizable straddle page will give you an immediate insight into how volatility has been moving relative to previous days and our system also lets you know if it is cheap or expensive. Leviathan’s proprietary system also tells you the expected range on the day based off of the current implied volatility. Know how to protect yourself, know when best to take advantage of high volatility to increase your returns, Leviathan helps you navigate the treacherous waters of volatility.