Ranking

Dig deeper into the specifics of the implied volatilities

What is Ranking Page?

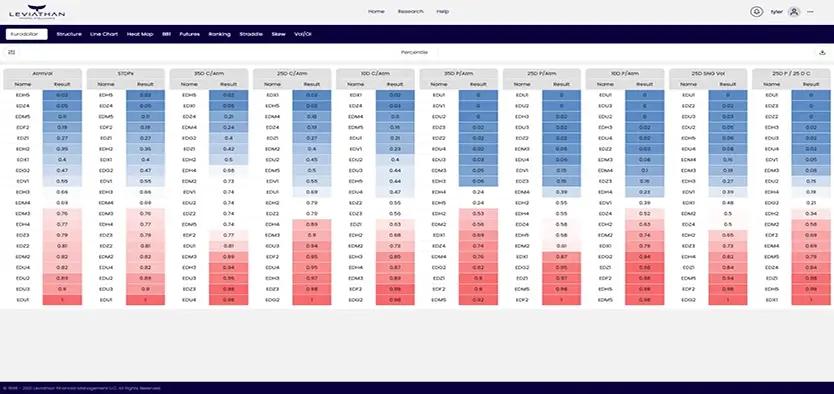

Ranking has some of the same characteristics as Skew, but is entirely its own animal. Whereas skew shows a representative smooth line of Volatilities across a delta or strike range, Ranking digs deep into the specifics of the implied volatilities. Ranking breaks options into delta buckets, which looks back historically at the Call/Put compared to At-the-money vol. Then the Ranking page displays the results in percentile form, showing which expiries are Rich (higher percentile) or Cheap (lower percentile) over your predefined time frame

How does knowing the Ranking help a trader?

Ranking is a deeper dive into skew. There are times when it is not clear whether options are truly cheap or rich by just looking at skew curves. Skew curves change shape or just slide along a defined volatility path which takes away the clarity of value. Sometimes it is better to evaluate option premiums by comparing that option to itself over time. Ranking takes a delta bucket view of entire underlying futures/stocks. For example, if a trader is looking at downside in XYZ, ranking will help that trader see which expiry has the cheapest/richest 10%/25%/35%/50% puts and calls over the time frame selected. Applying a percentile ranking is very important because an option may not be cheap just because it is the cheapest on the list. If the cheapest expiry of a 25 delta put is in the 80th percentile, that means all puts are expensive over the time frame selected. This is a tool that even the most novice traders can understand and the most professional traders can appreciate.

How can Leviathan Help

A big problem for option traders is selecting the best option/structure to represent your viewpoint. Which Call/Put to buy in XYZ if you are bullish/bearish? Should you put on an outright option or do a structure such as a vertical spread, butterfly, or condor? Leviathans Ranking Tool will identify the percentile ranking for ease of use. If you see all puts are in the 80th percentile or higher and are bearish, it may be better to buy a vertical Put spread rather than an outright Put. This takes the sting out of buying a rich option as another rich option is sold against it. Over time, mean reversion in Volatility and Skew will happen. Using Leviathan’s Ranking Tool will help the trader make informed decisions regarding which options to select in order to take advantage of positive or negative mean reversion by know which options are rich or cheap.