Weekly Options Trading Strategies

In the dynamic world of finance, weekly options provide a unique opportunity for investors to manage risk, enhance returns, and adapt to fluctuating market conditions. At Leviathan Financial Management, we craft robust weekly options trading strategies, drawing upon our extensive knowledge and innovative software solutions. We aim to equip traders with tools and strategies to capture market opportunities while managing risks.

Weekly options can seem daunting due to their compressed timelines. However, with the right approach, these instruments can be an excellent source of returns. Leveraging them requires a combination of keen market insights and timely actions. Our expertise at Leviathan Financial Management makes navigating this challenging terrain smoother, allowing traders to capitalize on short-term market movements.

Strategies Designed To Adapt to Market Fluctuations

Every week, the market presents traders with a fresh set of challenges and opportunities. Our weekly trading strategies are built to adapt swiftly to these ever-evolving conditions. We understand the essence of agility in the face of volatility, which is why our strategies incorporate real-time data and rapid execution protocols.

Furthermore, we recognize the importance of flexibility in trading. Our strategies are not rigid. Instead, they are designed to adjust based on market feedback. This ensures that traders using our strategies can pivot and recalibrate their approach, making the most of each week's trading window, regardless of market behavior.

How To Find the Right Weekly Option Trading Strategy To Meet Your Needs

Not every trading strategy suits all. Finding an approach that aligns with your financial goals, risk appetite, and trading style is crucial. At Leviathan, we offer a diverse range of weekly option strategies, ensuring there's something fitting for every trader. Whether you're risk-averse or seeking aggressive growth, we have a plan for you that involves any of these strategies:

- Covered Call: A strategy where an investor holds a long position in an underlying asset and sells a call option on the same asset.

- Protective Put: Also known as a married put, this strategy involves buying a put option to protect a long stock position from a potential downside risk.

- Bull Call Spread: A strategy that combines buying a call option and selling another with a higher strike price.

- Bear Put Spread: This strategy combines buying a put option and selling another put option with a lower strike price.

- Straddles: This is a non-directional strategy that involves buying both a call and a put option with the same strike price and expiration date.

- Iron Condors: A neutral strategy used in volatile markets that involves selling an out-of-the-money call and put while simultaneously buying further out-of-the-money call and put options.

- Butterfly Spreads: A neutral strategy that combines two vertical spreads with the same expiration date but different strike prices.

- Calendar Spreads: Also known as time spreads, this strategy involves buying and selling two options with the same strike price but different expiration dates.

Selecting the right strategy involves considering various factors, including your investment horizon, capital availability, and market outlook. Our option trading tutorial is an excellent resource for those looking to delve deeper into the nuances of options trading. With our guidance, you can identify and adopt a strategy that resonates with your trading aspirations.

Why Rely on Leviathan Financial Management for Your Options Strategies?

Leviathan Financial Management stands at the intersection of technology and financial expertise. Our commitment to excellence ensures that traders have access to the most advanced tools and strategies in the weekly options trading domain. We continuously refine our offerings, staying updated with market developments and integrating the latest technological advancements.

More than just strategies, we offer a partnership. Our team is dedicated to supporting traders at every step, ensuring they are equipped, informed, and empowered. With resources like our beginner options trading strategies and our comprehensive stock options value calculator, we provide an ecosystem where traders can thrive.

Sign Up Today For Weekly Options Playbook by Leviathan Financial Management

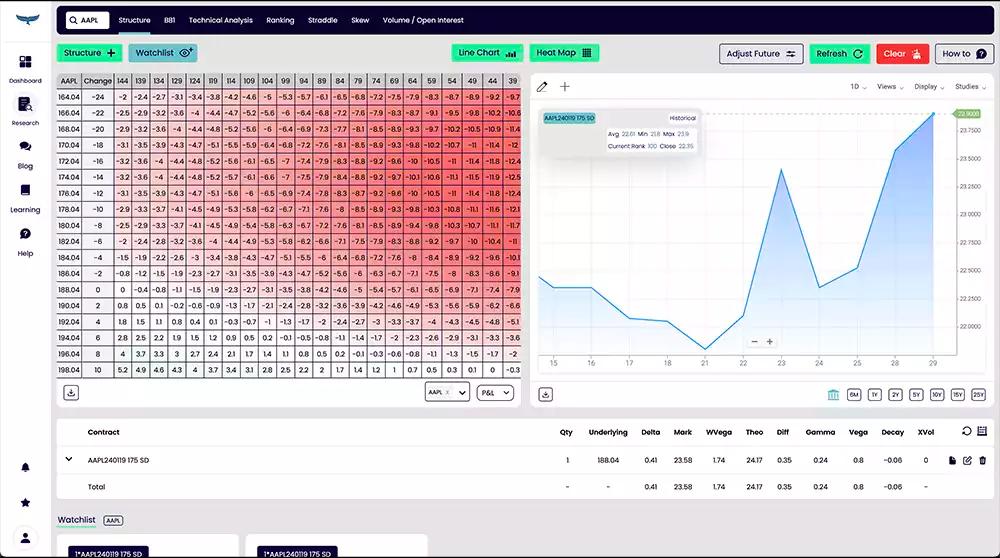

The world of weekly options trading is vast and filled with potential. At Leviathan Financial Management, we are dedicated to ensuring traders have everything they need to capitalize on these opportunities. From our robust learning catalog to our easy-to-use Structure Analyzer, you can discover the power of well-crafted strategies and make the most of your weekly options trading endeavors.